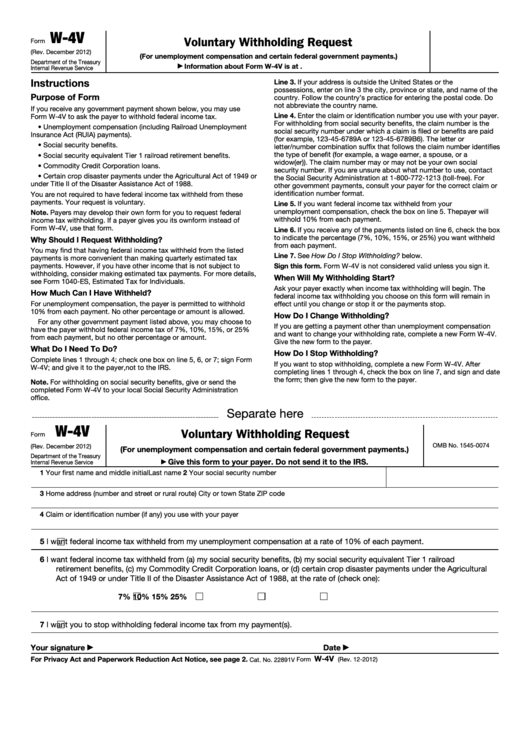

W-4V

Voluntary Withholding Request

Form

(Rev. December 2012)

(For unemployment compensation and certain federal government payments.)

Department of the Treasury

Information about Form W-4V is at

▶

Internal Revenue Service

Instructions

Line 3. If your address is outside the United States or the U.S.

possessions, enter on line 3 the city, province or state, and name of the

Purpose of Form

country. Follow the country’s practice for entering the postal code. Do

not abbreviate the country name.

If you receive any government payment shown below, you may use

Line 4. Enter the claim or identification number you use with your payer.

Form W-4V to ask the payer to withhold federal income tax.

For withholding from social security benefits, the claim number is the

• Unemployment compensation (including Railroad Unemployment

social security number under which a claim is filed or benefits are paid

Insurance Act (RUIA) payments).

(for example, 123-45-6789A or 123-45-6789B6). The letter or

• Social security benefits.

letter/number combination suffix that follows the claim number identifies

the type of benefit (for example, a wage earner, a spouse, or a

• Social security equivalent Tier 1 railroad retirement benefits.

widow(er)). The claim number may or may not be your own social

• Commodity Credit Corporation loans.

security number. If you are unsure about what number to use, contact

• Certain crop disaster payments under the Agricultural Act of 1949 or

the Social Security Administration at 1-800-772-1213 (toll-free). For

under Title II of the Disaster Assistance Act of 1988.

other government payments, consult your payer for the correct claim or

identification number format.

You are not required to have federal income tax withheld from these

payments. Your request is voluntary.

Line 5. If you want federal income tax withheld from your

unemployment compensation, check the box on line 5. The payer will

Note. Payers may develop their own form for you to request federal

withhold 10% from each payment.

income tax withholding. If a payer gives you its own form instead of

Form W-4V, use that form.

Line 6. If you receive any of the payments listed on line 6, check the box

to indicate the percentage (7%, 10%, 15%, or 25%) you want withheld

Why Should I Request Withholding?

from each payment.

You may find that having federal income tax withheld from the listed

Line 7. See How Do I Stop Withholding? below.

payments is more convenient than making quarterly estimated tax

payments. However, if you have other income that is not subject to

Sign this form. Form W-4V is not considered valid unless you sign it.

withholding, consider making estimated tax payments. For more details,

When Will My Withholding Start?

see Form 1040-ES, Estimated Tax for Individuals.

Ask your payer exactly when income tax withholding will begin. The

How Much Can I Have Withheld?

federal income tax withholding you choose on this form will remain in

For unemployment compensation, the payer is permitted to withhold

effect until you change or stop it or the payments stop.

10% from each payment. No other percentage or amount is allowed.

How Do I Change Withholding?

For any other government payment listed above, you may choose to

If you are getting a payment other than unemployment compensation

have the payer withhold federal income tax of 7%, 10%, 15%, or 25%

and want to change your withholding rate, complete a new Form W-4V.

from each payment, but no other percentage or amount.

Give the new form to the payer.

What Do I Need To Do?

How Do I Stop Withholding?

Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form

If you want to stop withholding, complete a new Form W-4V. After

W-4V; and give it to the payer, not to the IRS.

completing lines 1 through 4, check the box on line 7, and sign and date

the form; then give the new form to the payer.

Note. For withholding on social security benefits, give or send the

completed Form W-4V to your local Social Security Administration

office.

Separate here

W-4V

Voluntary Withholding Request

Form

OMB No. 1545-0074

(Rev. December 2012)

(For unemployment compensation and certain federal government payments.)

Department of the Treasury

Give this form to your payer. Do not send it to the IRS.

Internal Revenue Service

▶

1

2 Your social security number

Your first name and middle initial

Last name

3

Home address (number and street or rural route)

City or town

State

ZIP code

4

Claim or identification number (if any) you use with your payer

5

I want federal income tax withheld from my unemployment compensation at a rate of 10% of each payment.

6

I want federal income tax withheld from (a) my social security benefits, (b) my social security equivalent Tier 1 railroad

retirement benefits, (c) my Commodity Credit Corporation loans, or (d) certain crop disaster payments under the Agricultural

Act of 1949 or under Title II of the Disaster Assistance Act of 1988, at the rate of (check one):

7%

10%

15%

25%

7

I want you to stop withholding federal income tax from my payment(s).

Your signature

Date

▶

▶

W-4V

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Cat. No. 22891V

Form

(Rev. 12-2012)

1

1 2

2