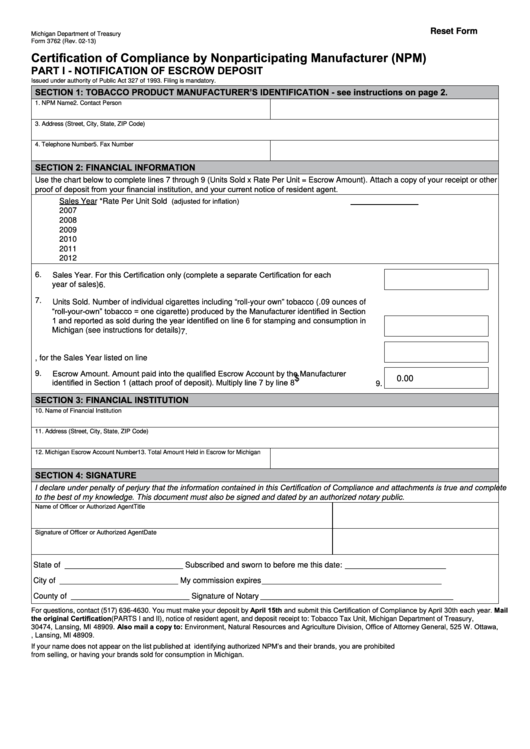

Reset Form

Michigan Department of Treasury

Form 3762 (Rev. 02-13)

Certification of Compliance by Nonparticipating Manufacturer (NPM)

PART I - NOTIFICATION OF ESCROW DEPOSIT

Issued under authority of Public Act 327 of 1993. Filing is mandatory.

SECTION 1: TOBACCO PRODUCT MANUFACTURER’S IDENTIFICATION - see instructions on page 2.

1. NPM Name

2. Contact Person

3. Address (Street, City, State, ZIP Code)

4. Telephone Number

5. Fax Number

SECTION 2: FINANCIAL INFORMATION

Use the chart below to complete lines 7 through 9 (Units Sold x Rate Per Unit = Escrow Amount). Attach a copy of your receipt or other

proof of deposit from your financial institution, and your current notice of resident agent.

(adjusted for inflation)

Sales Year

*Rate Per Unit Sold

2007 .....................................................................................................................................0.0251069

2008 .....................................................................................................................................0.0258601

2009 .....................................................................................................................................0.0266359

2010 .....................................................................................................................................0.0274350

2011 ......................................................................................................................................0.0282581

2012 .....................................................................................................................................0.0291058

Sales Year. For this Certification only (complete a separate Certification for each

6.

year of sales) .............................................................................................................................. 6.

7.

Units Sold. Number of individual cigarettes including “roll-your own” tobacco (.09 ounces of

“roll-your-own” tobacco = one cigarette) produced by the Manufacturer identified in Section

1 and reported as sold during the year identified on line 6 for stamping and consumption in

Michigan (see instructions for details) ........................................................................................ 7.

8.

Rate Per Unit from chart above, for the Sales Year listed on line 6............................................ 8.

Escrow Amount. Amount paid into the qualified Escrow Account by the Manufacturer

9.

$

0.00

identified in Section 1 (attach proof of deposit). Multiply line 7 by line 8 ....................................

9.

SECTION 3: FINANCIAL INSTITUTION

10. Name of Financial Institution

11. Address (Street, City, State, ZIP Code)

12. Michigan Escrow Account Number

13. Total Amount Held in Escrow for Michigan

SECTION 4: SIGNATURE

I declare under penalty of perjury that the information contained in this Certification of Compliance and attachments is true and complete

to the best of my knowledge. This document must also be signed and dated by an authorized notary public.

Name of Officer or Authorized Agent

Title

Signature of Officer or Authorized Agent

Date

State of

___________________________

Subscribed and sworn to before me this date: _______________________

City of

___________________________

My commission expires _________________________________________

County of ___________________________

Signature of Notary ____________________________________________

For questions, contact (517) 636-4630. You must make your deposit by April 15th and submit this Certification of Compliance by April 30th each year. Mail

the original Certification (PARTS I and II), notice of resident agent, and deposit receipt to: Tobacco Tax Unit, Michigan Department of Treasury, P.O. Box

30474, Lansing, MI 48909. Also mail a copy to: Environment, Natural Resources and Agriculture Division, Office of Attorney General, 525 W. Ottawa,

P.O. Box 30212, Lansing, MI 48909.

If your name does not appear on the list published at identifying authorized NPM’s and their brands, you are prohibited

from selling, or having your brands sold for consumption in Michigan.

1

1 2

2 3

3