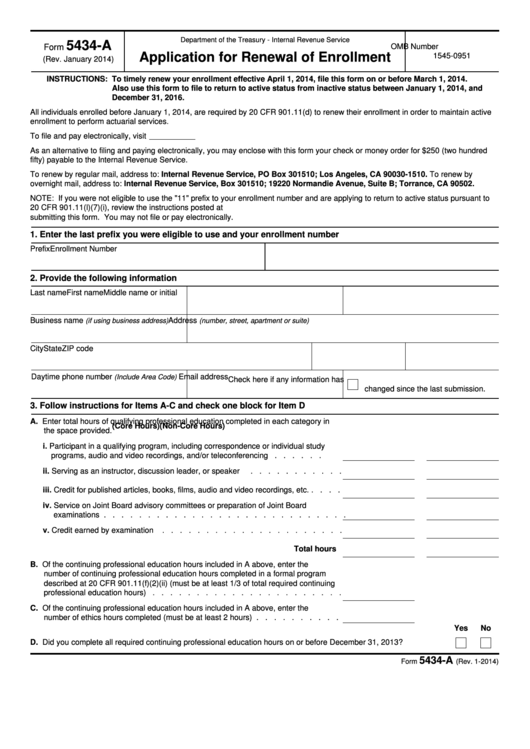

Department of the Treasury - Internal Revenue Service

5434-A

OMB Number

Form

Application for Renewal of Enrollment

1545-0951

(Rev. January 2014)

INSTRUCTIONS: To timely renew your enrollment effective April 1, 2014, file this form on or before March 1, 2014.

Also use this form to file to return to active status from inactive status between January 1, 2014, and

December 31, 2016.

All individuals enrolled before January 1, 2014, are required by 20 CFR 901.11(d) to renew their enrollment in order to maintain active

enrollment to perform actuarial services.

To file and pay electronically, visit

As an alternative to filing and paying electronically, you may enclose with this form your check or money order for $250 (two hundred

fifty) payable to the Internal Revenue Service.

To renew by regular mail, address to: Internal Revenue Service, PO Box 301510; Los Angeles, CA 90030-1510. To renew by

overnight mail, address to: Internal Revenue Service, Box 301510; 19220 Normandie Avenue, Suite B; Torrance, CA 90502.

NOTE: If you were not eligible to use the "11" prefix to your enrollment number and are applying to return to active status pursuant to

20 CFR 901.11(l)(7)(i), review the instructions posted at before completing or

submitting this form. You may not file or pay electronically.

1. Enter the last prefix you were eligible to use and your enrollment number

Prefix

Enrollment Number

2. Provide the following information

Last name

First name

Middle name or initial

Business name

Address

(if using business address)

(number, street, apartment or suite)

City

State

ZIP code

Daytime phone number

Email address

(Include Area Code)

Check here if any information has

changed since the last submission.

3. Follow instructions for Items A-C and check one block for Item D

A. Enter total hours of qualifying professional education completed in each category in

(Core Hours)

(Non-Core Hours)

the space provided.

i. Participant in a qualifying program, including correspondence or individual study

programs, audio and video recordings, and/or teleconferencing . . . . . .

ii. Serving as an instructor, discussion leader, or speaker

. . . . . . . . . . .

iii. Credit for published articles, books, films, audio and video recordings, etc. . . . .

iv. Service on Joint Board advisory committees or preparation of Joint Board

examinations . . . . . . . . . . . . . . . . . . . . . . . . . . . .

v. Credit earned by examination

. . . . . . . . . . . . . . . . . . . . .

Total hours

B. Of the continuing professional education hours included in A above, enter the

number of continuing professional education hours completed in a formal program

described at 20 CFR 901.11(f)(2)(ii) (must be at least 1/3 of total required continuing

professional education hours) . . . . . . . . . . . . . . . . . . . . . .

C. Of the continuing professional education hours included in A above, enter the

number of ethics hours completed (must be at least 2 hours) . . . . . . . . . .

Yes

No

D. Did you complete all required continuing professional education hours on or before December 31, 2013?

5434-A

Catalog Number 63767O

Form

(Rev. 1-2014)

1

1 2

2