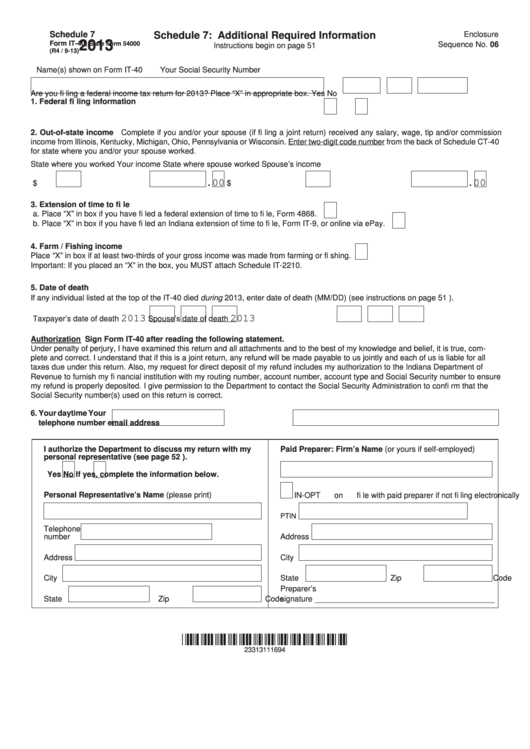

Schedule 7

Schedule 7: Additional Required Information

Enclosure

2013

Form IT-40,

State Form 54000

Sequence No. 06

Instructions begin on page 51

(R4 / 9-13)

Name(s) shown on Form IT-40

Your Social Security Number

1. Federal fi ling information

Are you fi ling a federal income tax return for 2013? Place “X” in appropriate box. Yes

No

2. Out-of-state income Complete if you and/or your spouse (if fi ling a joint return) received any salary, wage, tip and/or commission

income from Illinois, Kentucky, Michigan, Ohio, Pennsylvania or Wisconsin. Enter two-digit code number from the back of Schedule CT-40

for state where you and/or your spouse worked.

State where you worked

Your income

State where spouse worked

Spouse’s income

.00

.00

$

$

3. Extension of time to fi le

a. Place “X” in box if you have fi led a federal extension of time to fi le, Form 4868.

b. Place “X” in box if you have fi led an Indiana extension of time to fi le, Form IT-9, or online via ePay.

4. Farm / Fishing income

Place “X” in box if at least two-thirds of your gross income was made from farming or fi shing.

Important: If you placed an “X” in the box, you MUST attach Schedule IT-2210.

5. Date of death

If any individual listed at the top of the IT-40 died during 2013, enter date of death (MM/DD) (see instructions on page 51 ).

2013

2013

Taxpayer’s date of death

Spouse’s date of death

Authorization Sign Form IT-40 after reading the following statement.

Under penalty of perjury, I have examined this return and all attachments and to the best of my knowledge and belief, it is true, com-

plete and correct. I understand that if this is a joint return, any refund will be made payable to us jointly and each of us is liable for all

taxes due under this return. Also, my request for direct deposit of my refund includes my authorization to the Indiana Department of

Revenue to furnish my fi nancial institution with my routing number, account number, account type and Social Security number to ensure

my refund is properly deposited. I give permission to the Department to contact the Social Security Administration to confi rm that the

Social Security number(s) used on this return is correct.

6. Your daytime

Your

telephone number

email address

I authorize the Department to discuss my return with my

Paid Preparer: Firm’s Name (or yours if self-employed)

personal representative (see page 52 ).

Yes

No

If yes, complete the information below.

Personal Representative’s Name (please print)

IN-OPT on fi le with paid preparer if not fi ling electronically

PTIN

Telephone

number

Address

Address

City

City

State

Zip Code

Preparer’s

State

Zip Code

signature _________________________________________

23313111694

1

1