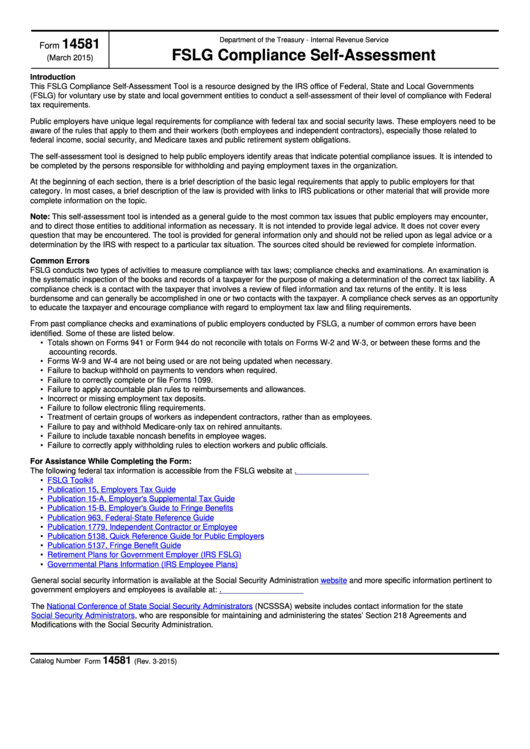

Department of the Treasury - Internal Revenue Service

14581

Form

FSLG Compliance Self-Assessment

(March 2015)

Introduction

This FSLG Compliance Self-Assessment Tool is a resource designed by the IRS office of Federal, State and Local Governments

(FSLG) for voluntary use by state and local government entities to conduct a self-assessment of their level of compliance with Federal

tax requirements.

Public employers have unique legal requirements for compliance with federal tax and social security laws. These employers need to be

aware of the rules that apply to them and their workers (both employees and independent contractors), especially those related to

federal income, social security, and Medicare taxes and public retirement system obligations.

The self-assessment tool is designed to help public employers identify areas that indicate potential compliance issues. It is intended to

be completed by the persons responsible for withholding and paying employment taxes in the organization.

At the beginning of each section, there is a brief description of the basic legal requirements that apply to public employers for that

category. In most cases, a brief description of the law is provided with links to IRS publications or other material that will provide more

complete information on the topic.

Note: This self-assessment tool is intended as a general guide to the most common tax issues that public employers may encounter,

and to direct those entities to additional information as necessary. It is not intended to provide legal advice. It does not cover every

question that may be encountered. The tool is provided for general information only and should not be relied upon as legal advice or a

determination by the IRS with respect to a particular tax situation. The sources cited should be reviewed for complete information.

Common Errors

FSLG conducts two types of activities to measure compliance with tax laws; compliance checks and examinations. An examination is

the systematic inspection of the books and records of a taxpayer for the purpose of making a determination of the correct tax liability. A

compliance check is a contact with the taxpayer that involves a review of filed information and tax returns of the entity. It is less

burdensome and can generally be accomplished in one or two contacts with the taxpayer. A compliance check serves as an opportunity

to educate the taxpayer and encourage compliance with regard to employment tax law and filing requirements.

From past compliance checks and examinations of public employers conducted by FSLG, a number of common errors have been

identified. Some of these are listed below.

• Totals shown on Forms 941 or Form 944 do not reconcile with totals on Forms W-2 and W-3, or between these forms and the

accounting records.

• Forms W-9 and W-4 are not being used or are not being updated when necessary.

• Failure to backup withhold on payments to vendors when required.

• Failure to correctly complete or file Forms 1099.

• Failure to apply accountable plan rules to reimbursements and allowances.

• Incorrect or missing employment tax deposits.

• Failure to follow electronic filing requirements.

• Treatment of certain groups of workers as independent contractors, rather than as employees.

• Failure to pay and withhold Medicare-only tax on rehired annuitants.

• Failure to include taxable noncash benefits in employee wages.

• Failure to correctly apply withholding rules to election workers and public officials.

For Assistance While Completing the Form:

The following federal tax information is accessible from the FSLG website at

•

FSLG Toolkit

•

Publication 15, Employers Tax Guide

•

Publication 15-A, Employer's Supplemental Tax Guide

•

Publication 15-B, Employer's Guide to Fringe Benefits

•

Publication 963, Federal-State Reference Guide

•

Publication 1779, Independent Contractor or Employee

•

Publication 5138, Quick Reference Guide for Public Employers

•

Publication 5137, Fringe Benefit Guide

•

Retirement Plans for Government Employer (IRS FSLG)

•

Governmental Plans Information (IRS Employee Plans)

General social security information is available at the Social Security Administration

website

and more specific information pertinent to

government employers and employees is available at:

The

National Conference of State Social Security Administrators

(NCSSSA) website includes contact information for the state

Social Security

Administrators, who are responsible for maintaining and administering the states’ Section 218 Agreements and

Modifications with the Social Security Administration.

14581

Catalog Number 66247V

Form

(Rev. 3-2015)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14