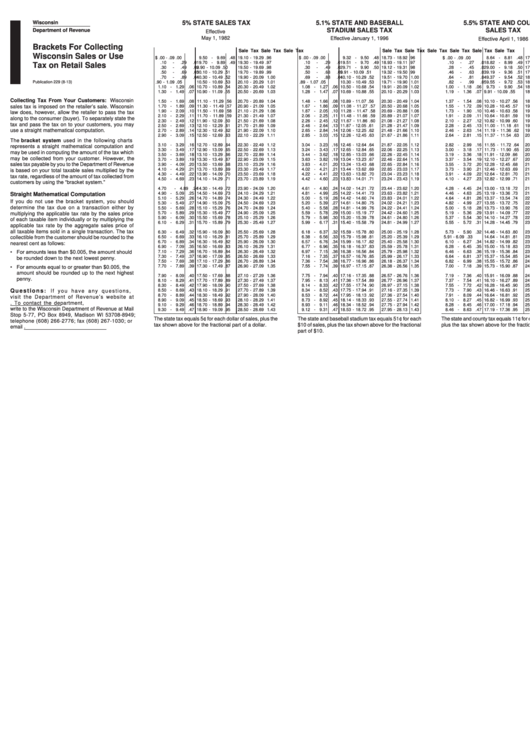

Brackets For Collecting Wisconsin Sales Or Use Tax On Retail Sales

ADVERTISEMENT

Wisconsin

5% STATE SALES TAX

5.1% STATE AND BASEBALL

5.5% STATE AND COUNTY

Department of Revenue

STADIUM SALES TAX

SALES TAX

Effective

May 1, 1982

Effective January 1, 1996

Effective April 1, 1986

Brackets For Collecting

Sale

Tax

Sale

Tax

Sale

Tax

Sale

Tax

Sale

Tax

Sale

Tax

Sale

Tax

Sale

Tax

Sale

Tax

Wisconsin Sales or Use

$ .00 -

.09

.00

9.50 - 9.69

.48

19.10 - 19.29

.96

$ .00 -

.09

.00

9.32 - 9.50

.48

18.73 - 18.92

.96

$ .00 -

.09

.00

8.64 - 8.81

.48

17.37 - 17.54

.96

.10 -

.29

.01

9.70 - 9.89

.49

19.30 - 19.49

.97

.10 -

.29

.01

9.51 - 9.70

.49

18.93 - 19.11

.97

.10 -

.27

.01

8.82 - 8.99

.49

17.55 - 17.72

.97

Tax on Retail Sales

.30 -

.49

.02

9.90 - 10.09

.50

19.50 - 19.69

.98

.30 -

.49

.02

9.71 - 9.90

.50

19.12 - 19.31

.98

.28 -

.45

.02

9.00 - 9.18

.50

17.73 - 17.90

.98

.50 -

.69

.03

10.10 - 10.29

.51

19.70 - 19.89

.99

.50 -

.68

.03

9.91 - 10.09

.51

19.32 - 19.50

.99

.46 -

.63

.03

9.19 - 9.36

.51

17.91 - 18.09

.99

.70 -

.89

.04

10.30 - 10.49

.52

19.90 - 20.09 1.00

.69 -

.88

.04

10.10 - 10.29

.52

19.51 - 19.70 1.00

.64 -

.81

.04

9.37 - 9.54

.52

18.10 - 18.27 1.00

Publication 229 (8-13)

.90 - 1.09

.05

10.50 - 10.69

.53

20.10 - 20.29 1.01

.89 - 1.07

.05

10.30 - 10.49

.53

19.71 - 19.90 1.01

.82 -

.99

.05

9.55 - 9.72

.53

18.28 - 18.45 1.01

1.10 - 1.29

.06

10.70 - 10.89

.54

20.30 - 20.49 1.02

1.08 - 1.27

.06

10.50 - 10.68

.54

19.91 - 20.09 1.02

1.00 - 1.18

.06

9.73 - 9.90

.54

18.46 - 18.63 1.02

1.30 - 1.49

.07

10.90 - 11.09

.55

20.50 - 20.69 1.03

1.28 - 1.47

.07

10.69 - 10.88

.55

20.10 - 20.29 1.03

1.19 - 1.36

.07

9.91 - 10.09

.55

18.64 - 18.81 1.03

Collecting Tax From Your Customers: Wisconsin

1.50 - 1.69

.08

11.10 - 11.29

.56

20.70 - 20.89 1.04

1.48 - 1.66

.08

10.89 - 11.07

.56

20.30 - 20.49 1.04

1.37 - 1.54

.08

10.10 - 10.27

.56

18.82 - 18.99 1.04

sales tax is imposed on the retailer’s sale. Wisconsin

1.70 - 1.89

.09

11.30 - 11.49

.57

20.90 - 21.09 1.05

1.67 - 1.86

.09

11.08 - 11.27

.57

20.50 - 20.68 1.05

1.55 - 1.72

.09

10.28 - 10.45

.57

19.00 - 19.18 1.05

1.90 - 2.09

.10

11.50 - 11.69

.58

21.10 - 21.29 1.06

1.87 - 2.05

.10

11.28 - 11.47

.58

20.69 - 20.88 1.06

1.73 - 1.90

.10

10.46 - 10.63

.58

19.19 - 19.36 1.06

law does, however, allow the retailer to pass the tax

2.10 - 2.29

.11

11.70 - 11.89

.59

21.30 - 21.49 1.07

2.06 - 2.25

.11

11.48 - 11.66

.59

20.89 - 21.07 1.07

1.91 - 2.09

.11

10.64 - 10.81

.59

19.37 - 19.54 1.07

along to the consumer (buyer). To separately state the

2.30 - 2.49

.12

11.90 - 12.09

.60

21.50 - 21.69 1.08

2.26 - 2.45

.12

11.67 - 11.86

.60

21.08 - 21.27 1.08

2.10 - 2.27

.12

10.82 - 10.99

.60

19.55 - 19.72 1.08

tax and pass the tax on to your customers, you may

2.50 - 2.69

.13

12.10 - 12.29

.61

21.70 - 21.89 1.09

2.46 - 2.64

.13

11.87 - 12.05

.61

21.28 - 21.47 1.09

2.28 - 2.45

.13

11.00 - 11.18

.61

19.73 - 19.90 1.09

use a straight mathematical computation.

2.70 - 2.89

.14

12.30 - 12.49

.62

21.90 - 22.09 1.10

2.65 - 2.84

.14

12.06 - 12.25

.62

21.48 - 21.66 1.10

2.46 - 2.63

.14

11.19 - 11.36

.62

19.91 - 20.09 1.10

2.90 - 3.09

.15

12.50 - 12.69

.63

22.10 - 22.29 1.11

2.85 - 3.03

.15

12.26 - 12.45

.63

21.67 - 21.86 1.11

2.64 - 2.81

.15

11.37 - 11.54

.63

20.10 - 20.27 1.11

The bracket system used in the following charts

3.10 - 3.29

.16

12.70 - 12.89

.64

22.30 - 22.49 1.12

3.04 - 3.23

.16

12.46 - 12.64

.64

21.87 - 22.05 1.12

2.82 - 2.99

.16

11.55 - 11.72

.64

20.28 - 20.45 1.12

represents a straight mathematical computation and

3.30 - 3.49

.17

12.90 - 13.09

.65

22.50 - 22.69 1.13

3.24 - 3.43

.17

12.65 - 12.84

.65

22.06 - 22.25 1.13

3.00 - 3.18

.17

11.73 - 11.90

.65

20.46 - 20.63 1.13

may be used in computing the amount of the tax which

3.50 - 3.69

.18

13.10 - 13.29

.66

22.70 - 22.89 1.14

3.44 - 3.62

.18

12.85 - 13.03

.66

22.26 - 22.45 1.14

3.19 - 3.36

.18

11.91 - 12.09

.66

20.64 - 20.81 1.14

may be collected from your customer. However, the

3.70 - 3.89

.19

13.30 - 13.49

.67

22.90 - 23.09 1.15

3.63 - 3.82

.19

13.04 - 13.23

.67

22.46 - 22.64 1.15

3.37 - 3.54

.19

12.10 - 12.27

.67

20.82 - 20.99 1.15

sales tax payable by you to the Department of Revenue

3.90 - 4.09

.20

13.50 - 13.69

.68

23.10 - 23.29 1.16

3.83 - 4.01

.20

13.24 - 13.43

.68

22.65 - 22.84 1.16

3.55 - 3.72

.20

12.28 - 12.45

.68

21.00 - 21.18 1.16

4.10 - 4.29

.21

13.70 - 13.89

.69

23.30 - 23.49 1.17

4.02 - 4.21

.21

13.44 - 13.62

.69

22.85 - 23.03 1.17

3.73 - 3.90

.21

12.46 - 12.63

.69

21.19 - 21.36 1.17

is based on your total taxable sales multiplied by the

4.30 - 4.49

.22

13.90 - 14.09

.70

23.50 - 23.69 1.18

4.22 - 4.41

.22

13.63 - 13.82

.70

23.04 - 23.23 1.18

3.91 - 4.09

.22

12.64 - 12.81

.70

21.37 - 21.54 1.18

tax rate, regardless of the amount of tax collected from

4.50 - 4.69

.23

14.10 - 14.29

.71

23.70 - 23.89 1.19

4.42 - 4.60

.23

13.83 - 14.01

.71

23.24 - 23.43 1.19

4.10 - 4.27

.23

12.82 - 12.99

.71

21.55 - 21.72 1.19

customers by using the “bracket system.”

4.70 - 4.89

.24

14.30 - 14.49

.72

23.90 - 24.09 1.20

4.61 - 4.80

.24

14.02 - 14.21

.72

23.44 - 23.62 1.20

4.28 - 4.45

.24

13.00 - 13.18

.72

21.73 - 21.90 1.20

4.90 - 5.09

.25

14.50 - 14.69

.73

24.10 - 24.29 1.21

4.81 - 4.99

.25

14.22 - 14.41

.73

23.63 - 23.82 1.21

4.46 - 4.63

.25

13.19 - 13.36

.73

21.91 - 22.09 1.21

Straight Mathematical Computation

5.10 - 5.29

.26

14.70 - 14.89

.74

24.30 - 24.49 1.22

5.00 - 5.19

.26

14.42 - 14.60

.74

23.83 - 24.01 1.22

4.64 - 4.81

.26

13.37 - 13.54

.74

22.10 - 22.27 1.22

If you do not use the bracket system, you should

5.30 - 5.49

.27

14.90 - 15.09

.75

24.50 - 24.69 1.23

5.20 - 5.39

.27

14.61 - 14.80

.75

24.02 - 24.21 1.23

4.82 - 4.99

.27

13.55 - 13.72

.75

22.28 - 22.45 1.23

determine the tax due on a transaction either by

5.50 - 5.69

.28

15.10 - 15.29

.76

24.70 - 24.89 1.24

5.40 - 5.58

.28

14.81 - 14.99

.76

24.22 - 24.41 1.24

5.00 - 5.18

.28

13.73 - 13.90

.76

22.46 - 22.63 1.24

5.70 - 5.89

.29

15.30 - 15.49

.77

24.90 - 25.09 1.25

5.59 - 5.78

.29

15.00 - 15.19

.77

24.42 - 24.60 1.25

5.19 - 5.36

.29

13.91 - 14.09

.77

22.64 - 22.81 1.25

multiplying the applicable tax rate by the sales price

5.90 - 6.09

.30

15.50 - 15.69

.78

25.10 - 25.29 1.26

5.79 - 5.98

.30

15.20 - 15.39

.78

24.61 - 24.80 1.26

5.37 - 5.54

.30

14.10 - 14.27

.78

22.82 - 22.99 1.26

of each taxable item individually or by multiplying the

6.10 - 6.29

.31

15.70 - 15.89

.79

25.30 - 25.49 1.27

5.99 - 6.17

.31

15.40 - 15.58

.79

24.81 - 24.99 1.27

5.55 - 5.72

.31

14.28 - 14.45

.79

23.00 - 23.18 1.27

applicable tax rate by the aggregate sales price of

all taxable items sold in a single transaction. The tax

6.30 - 6.49

.32

15.90 - 16.09

.80

25.50 - 25.69 1.28

6.18 - 6.37

.32

15.59 - 15.78

.80

25.00 - 25.19 1.28

5.73 - 5.90

.32

14.46 - 14.63

.80

23.19 - 23.36 1.28

collectible from the customer should be rounded to the

6.50 - 6.69

.33

16.10 - 16.29

.81

25.70 - 25.89 1.29

6.38 - 6.56

.33

15.79 - 15.98

.81

25.20 - 25.39 1.29

5.91 - 6.09

.33

14.64 - 14.81

.81

23.37 - 23.54 1.29

6.70 - 6.89

.34

16.30 - 16.49

.82

25.90 - 26.09 1.30

6.57 - 6.76

.34

15.99 - 16.17

.82

25.40 - 25.58 1.30

6.10 - 6.27

.34

14.82 - 14.99

.82

23.55 - 23.72 1.30

nearest cent as follows:

6.90 - 7.09

.35

16.50 - 16.69

.83

26.10 - 26.29 1.31

6.77 - 6.96

.35

16.18 - 16.37

.83

25.59 - 25.78 1.31

6.28 - 6.45

.35

15.00 - 15.18

.83

23.73 - 23.90 1.31

• For amounts less than $0.005, the amount should

7.10 - 7.29

.36

16.70 - 16.89

.84

26.30 - 26.49 1.32

6.97 - 7.15

.36

16.38 - 16.56

.84

25.79 - 25.98 1.32

6.46 - 6.63

.36

15.19 - 15.36

.84

23.91 - 24.09 1.32

7.30 - 7.49

.37

16.90 - 17.09

.85

26.50 - 26.69 1.33

7.16 - 7.35

.37

16.57 - 16.76

.85

25.99 - 26.17 1.33

6.64 - 6.81

.37

15.37 - 15.54

.85

24.10 - 24.27 1.33

be rounded down to the next lowest penny.

7.50 - 7.69

.38

17.10 - 17.29

.86

26.70 - 26.89 1.34

7.36 - 7.54

.38

16.77 - 16.96

.86

26.18 - 26.37 1.34

6.82 - 6.99

.38

15.55 - 15.72

.86

24.28 - 24.45 1.34

• For amounts equal to or greater than $0.005, the

7.70 - 7.89

.39

17.30 - 17.49

.87

26.90 - 27.09 1.35

7.55 - 7.74

.39

16.97 - 17.15

.87

26.38 - 26.56 1.35

7.00 - 7.18

.39

15.73 - 15.90

.87

24.46 - 24.63 1.35

amount should be rounded up to the next highest

7.90 - 8.09

.40

17.50 - 17.69

.88

27.10 - 27.29 1.36

7.75 - 7.94

.40

17.16 - 17.35

.88

26.57 - 26.76 1.36

7.19 - 7.36

.40

15.91 - 16.09

.88

24.64 - 24.81 1.36

penny.

8.10 - 8.29

.41

17.70 - 17.89

.89

27.30 - 27.49 1.37

7.95 - 8.13

.41

17.36 - 17.54

.89

26.77 - 26.96 1.37

7.37 - 7.54

.41

16.10 - 16.27

.89

24.82 - 24.99 1.37

8.30 - 8.49

.42

17.90 - 18.09

.90

27.50 - 27.69 1.38

8.14 - 8.33

.42

17.55 - 17.74

.90

26.97 - 27.15 1.38

7.55 - 7.72

.42

16.28 - 16.45

.90

25.00 - 25.18 1.38

Q u e s t i o n s

:

I f y o u h a v e a n y q u e s t i o n s ,

8.50 - 8.69

.43

18.10 - 18.29

.91

27.70 - 27.89 1.39

8.34 - 8.52

.43

17.75 - 17.94

.91

27.16 - 27.35 1.39

7.73 - 7.90

.43

16.46 - 16.63

.91

25.19 - 25.36 1.39

8.70 - 8.89

.44

18.30 - 18.49

.92

27.90 - 28.09 1.40

8.53 - 8.72

.44

17.95 - 18.13

.92

27.36 - 27.54 1.40

7.91 - 8.09

.44

16.64 - 16.81

.92

25.37 - 25.54 1.40

visit the Department of Revenue’s website at

8.90 - 9.09

.45

18.50 - 18.69

.93

28.10 - 28.29 1.41

8.73 - 8.92

.45

18.14 - 18.33

.93

27.55 - 27.74 1.41

8.10 - 8.27

.45

16.82 - 16.99

.93

25.55 - 25.72 1.41

To contact the department,

9.10 - 9.29

.46

18.70 - 18.89

.94

28.30 - 28.49 1.42

8.93 - 9.11

.46

18.34 - 18.52

.94

27.75 - 27.94 1.42

8.28 - 8.45

.46

17.00 - 17.18

.94

25.73 - 25.90 1.42

write to the Wisconsin Department of Revenue at Mail

9.30 - 9.49

.47

18.90 - 19.09

.95

28.50 - 28.69 1.43

9.12 - 9.31

.47

18.53 - 18.72

.95

27.95 - 28.13 1.43

8.46 - 8.63

.47

17.19 - 17.36

.95

25.91 - 26.09 1.43

Stop 5-77, PO Box 8949, Madison WI 53708-8949;

The state tax equals 5¢ for each dollar of sales, plus the

The state and baseball stadium tax equals 51¢ for each

The state and county tax equals 11¢ for each $2 of sales,

telephone (608) 266-2776; fax (608) 267-1030; or

tax shown above for the fractional part of a dollar.

$10 of sales, plus the tax shown above for the fractional

plus the tax shown above for the fractional part of $2.

email DORSalesandUse@wisconsin.gov.

part of $10.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2