Form Rpd-41138 - Extension Of Time To File For Oil And Gas Taxes

ADVERTISEMENT

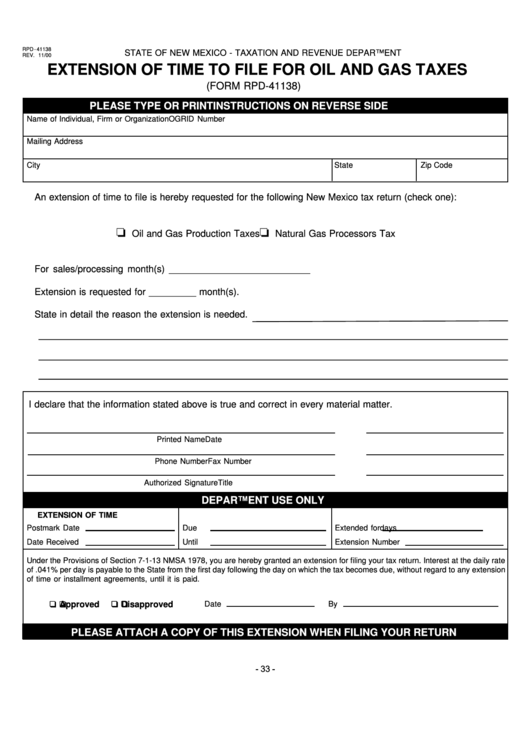

RPD - 41138

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV. 11/00

EXTENSION OF TIME TO FILE FOR OIL AND GAS TAXES

(FORM RPD-41138)

PLEASE TYPE OR PRINT

INSTRUCTIONS ON REVERSE SIDE

Name of Individual, Firm or Organization

OGRID Number

Mailing Address

City

State

Zip Code

An extension of time to file is hereby requested for the following New Mexico tax return (check one):

❏

❏

Oil and Gas Production Taxes

Natural Gas Processors Tax

For sales/processing month(s) ___________________________

Extension is requested for _________ month(s).

State in detail the reason the extension is needed.

I declare that the information stated above is true and correct in every material matter.

Printed Name

Date

Phone Number

Fax Number

Authorized Signature

Title

DEPARTMENT USE ONLY

EXTENSION OF TIME

Postmark Date

Due

Extended for

days

Date Received

Until

Extension Number

Under the Provisions of Section 7-1-13 NMSA 1978, you are hereby granted an extension for filing your tax return. Interest at the daily rate

of .041% per day is payable to the State from the first day following the day on which the tax becomes due, without regard to any extension

of time or installment agreements, until it is paid.

❑ ❑ ❑ ❑ ❑ Approved

❑ ❑ ❑ ❑ ❑ Disapproved

Date

By

PLEASE ATTACH A COPY OF THIS EXTENSION WHEN FILING YOUR RETURN

- 33 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2