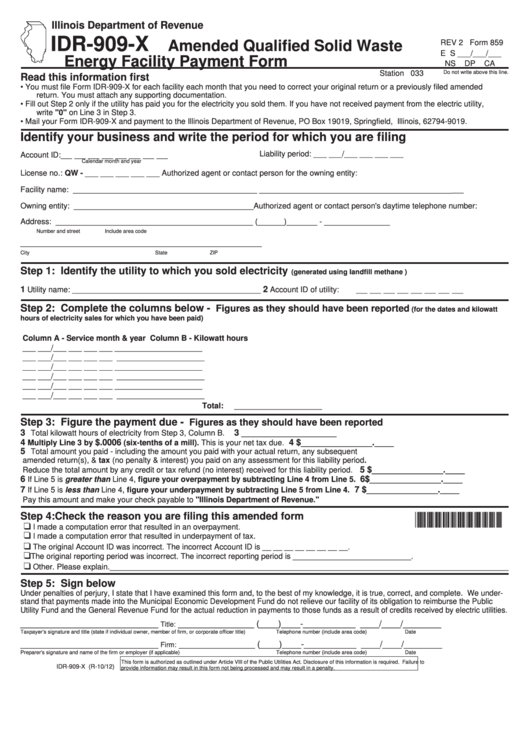

Illinois Department of Revenue

IDR-909-X

REV 2 Form 859

Amended Qualified Solid Waste

E S ___/___/___

Energy Facility Payment Form

NS DP CA

Do not write above this line.

Station 033

Read this information first

•

You must file Form IDR-909-X for each facility each month that you need to correct your original return or a previously filed amended

return. You must attach any supporting documentation.

•

Fill out Step 2 only if the utility has paid you for the electricity you sold them. If you have not received payment from the electric utility,

write "0" on Line 3 in Step 3.

•

Mail your Form IDR-909-X and payment to the Illinois Department of Revenue, PO Box 19019, Springfield, Illinois, 62794-9019.

Identify your business and write the period for which you are filing

Account ID:__ __ __ __ __ __ __ __

Liability period: ___ ___/___ ___ ___ ___

Calendar month and year

License no.: QW - ___ ___ ___ ___ ___

Authorized agent or contact person for the owning entity:

Facility name: __________________________________________

____________________________________________

___

Owning entity: _________________________________________

Authorized agent or contact person's daytime telephone number:

Address:

_____________________________________________

(______)_______ - _______________

Number and street

Include area code

______________________________________________________

City State ZIP

Step 1: Identify the utility to which you sold electricity

(generated using landfill methane )

1

2

Utility name: ___________________________________________

Account ID of utility: __ __ __ __ __ __ __ __

Step 2: Complete the columns below -

Figures as they should have been reported

(for the dates and kilowatt

hours of electricity sales for which you have been paid)

Column A - Service month & year

Column B - Kilowatt hours

___ ___/___ ___ ___ ___

____________________

___ ___/___ ___ ___ ___

____________________

___ ___/___ ___ ___ ___

____________________

___ ___/___ ___ ___ ___

____________________

___ ___/___ ___ ___ ___

____________________

___ ___/___ ___ ___ ___

____________________

Total: ____________________

Step 3: Figure the payment due -

Figures as they should have been reported

3

3

____________________

Total kilowatt hours of electricity from Step 3, Column B.

4

$.0006

4 $_______________.____

Multiply Line 3 by

(six-tenths of a mill). This is your net tax due.

5

Total amount you paid - including the amount you paid with your actual return, any subsequent

amended return(s), & tax (no penalty & interest) you paid on any assessment for this liability period.

5 $_______________.____

Reduce the total amount by any credit or tax refund (no interest) received for this liability period.

6

6 $_______________.____

If Line 5 is greater than Line 4, figure your overpayment by subtracting Line 4 from Line 5.

7

7 $_______________.____

If Line 5 is less than Line 4, figure your underpayment by subtracting Line 5 from Line 4.

Pay this amount and make your check payable to "Illinois Department of Revenue."

*285901110*

Step 4: Check the reason you are filing this amended form

❑

I made a computation error that resulted in an overpayment.

❑

I made a computation error that resulted in underpayment of tax.

❑

The original Account ID was incorrect. The incorrect Account ID is __ __ __ __ __ __ __ __.

❑

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

❑

Other. Please explain.___________________________________________________________________________________________

Step 5: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete. We under-

stand that payments made into the Municipal Economic Development Fund do not relieve our facility of its obligation to reimburse the Public

Utility Fund and the General Revenue Fund for the actual reduction in payments to those funds as a result of credits received by electric utilities.

_____________________________

________________

(____)____-___________

____/____/________

Title:

Taxpayer’s signature and title (state if individual owner, member of firm, or corporate officer title) Telephone number (include area code) Date

_____________________________

________________

(____)____-___________

____/____/________

Firm:

Preparer's signature and name of the firm or employer (if applicable) Telephone number (include area code) Date

This form is authorized as outlined under Article VIII of the Public Utilities Act. Disclosure of this information is required. Failure to

IDR-909-X (R-10/12)

provide information may result in this form not being processed and may result in a penalty.

1

1