*VADFT1110888*

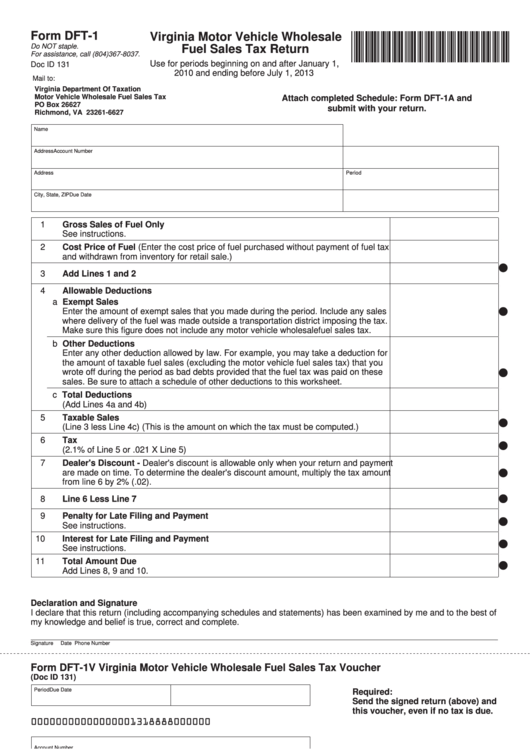

Form DFT-1

Virginia Motor Vehicle Wholesale

Do NOT staple.

Fuel Sales Tax Return

For assistance, call (804)367-8037.

Use for periods beginning on and after January 1,

Doc ID 131

2010 and ending before July 1, 2013

Mail to:

Virginia Department Of Taxation

Motor Vehicle Wholesale Fuel Sales Tax

Attach completed Schedule: Form DFT-1A and

PO Box 26627

submit with your return.

Richmond, VA 23261-6627

Name

Address

Account Number

Address

Period

City, State, ZIP

Due Date

1

Gross Sales of Fuel Only

See instructions.

2

Cost Price of Fuel (Enter the cost price of fuel purchased without payment of fuel tax

and withdrawn from inventory for retail sale.)

n

3

Add Lines 1 and 2

4

Allowable Deductions

a Exempt Sales

n

Enter the amount of exempt sales that you made during the period. Include any sales

where delivery of the fuel was made outside a transportation district imposing the tax.

Make sure this figure does not include any motor vehicle wholesale fuel sales tax.

b Other Deductions

Enter any other deduction allowed by law. For example, you may take a deduction for

the amount of taxable fuel sales (excluding the motor vehicle fuel sales tax) that you

n

wrote off during the period as bad debts provided that the fuel tax was paid on these

sales. Be sure to attach a schedule of other deductions to this worksheet.

c Total Deductions

(Add Lines 4a and 4b)

5

Taxable Sales

n

(Line 3 less Line 4c) (This is the amount on which the tax must be computed.)

6

Tax

n

(2.1% of Line 5 or .021 X Line 5)

7

Dealer's Discount - Dealer's discount is allowable only when your return and payment

n

are made on time. To determine the dealer's discount amount, multiply the tax amount

from line 6 by 2% (.02).

n

8

Line 6 Less Line 7

9

Penalty for Late Filing and Payment

n

See instructions.

10

Interest for Late Filing and Payment

n

See instructions.

11

Total Amount Due

n

Add Lines 8, 9 and 10.

Declaration and Signature

I declare that this return (including accompanying schedules and statements) has been examined by me and to the best of

my knowledge and belief is true, correct and complete.

Signature

Date

Phone Number

Form DFT-1V Virginia Motor Vehicle Wholesale Fuel Sales Tax Voucher

(Doc ID 131)

Period

Due Date

Required:

Send the signed return (above) and

this voucher, even if no tax is due.

0000000000000000 1318888 000000

Account Number

Name

Address

Total Amount Due

Address

(Line 11 of above return.)

City, State, ZIP

.

Va. Dept. of Taxation

Form DFT-1 W 2601167 REV 07/13

1

1 2

2