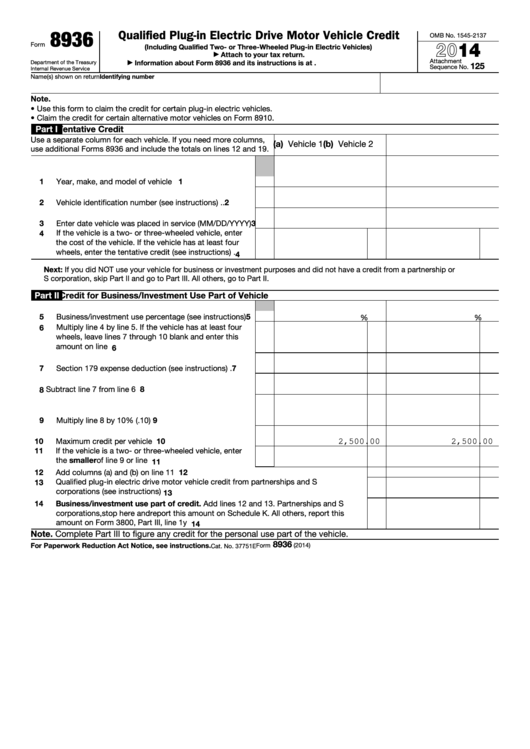

8936

Qualified Plug-in Electric Drive Motor Vehicle Credit

OMB No. 1545-2137

2014

Form

(Including Qualified Two- or Three-Wheeled Plug-in Electric Vehicles)

Attach to your tax return.

▶

Attachment

Information about Form 8936 and its instructions is at

Department of the Treasury

▶

125

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Note.

• Use this form to claim the credit for certain plug-in electric vehicles.

• Claim the credit for certain alternative motor vehicles on Form 8910.

Part I

Tentative Credit

Use a separate column for each vehicle. If you need more columns,

(a) Vehicle 1

(b) Vehicle 2

use additional Forms 8936 and include the totals on lines 12 and 19.

1

1

Year, make, and model of vehicle .

.

.

.

.

.

.

2

Vehicle identification number (see instructions)

.

.

2

3

3

Enter date vehicle was placed in service (MM/DD/YYYY)

If the vehicle is a two- or three-wheeled vehicle, enter

4

the cost of the vehicle. If the vehicle has at least four

wheels, enter the tentative credit (see instructions)

.

4

Next: If you did NOT use your vehicle for business or investment purposes and did not have a credit from a partnership or

S corporation, skip Part II and go to Part III. All others, go to Part II.

Part II

Credit for Business/Investment Use Part of Vehicle

5

Business/investment use percentage (see instructions)

5

%

%

Multiply line 4 by line 5. If the vehicle has at least four

6

wheels, leave lines 7 through 10 blank and enter this

amount on line 11 .

.

.

.

.

.

.

.

.

.

.

.

6

7

Section 179 expense deduction (see instructions)

.

7

8

Subtract line 7 from line 6

.

.

.

.

.

.

.

.

.

8

9

Multiply line 8 by 10% (.10) .

.

.

.

.

.

.

.

.

9

10

Maximum credit per vehicle .

.

.

.

.

.

.

.

.

10

2,500.00

2,500.00

11

If the vehicle is a two- or three-wheeled vehicle, enter

the smaller of line 9 or line 10 .

.

.

.

.

.

.

.

11

12

Add columns (a) and (b) on line 11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Qualified plug-in electric drive motor vehicle credit from partnerships and S

13

corporations (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14

Business/investment use part of credit. Add lines 12 and 13. Partnerships and S

corporations, stop here and report this amount on Schedule K. All others, report this

amount on Form 3800, Part III, line 1y

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

Note. Complete Part III to figure any credit for the personal use part of the vehicle.

8936

For Paperwork Reduction Act Notice, see instructions.

Form

(2014)

Cat. No. 37751E

1

1 2

2 3

3 4

4