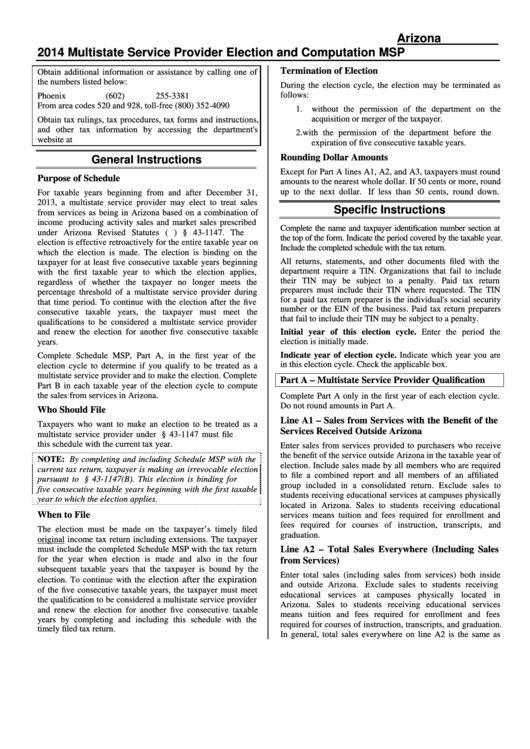

Instructions For Schedule Msp - Arizona Multistate Service Provider Election And Computation - 2014

ADVERTISEMENT

Arizona Schedule

2014 Multistate Service Provider Election and Computation

MSP

Termination of Election

Obtain additional information or assistance by calling one of

the numbers listed below:

During the election cycle, the election may be terminated as

follows:

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

1. without the permission of the department on the

acquisition or merger of the taxpayer.

Obtain tax rulings, tax procedures, tax forms and instructions,

and other tax information by accessing the department's

2. with the permission of the department before the

website at

expiration of five consecutive taxable years.

Rounding Dollar Amounts

General Instructions

Except for Part A lines A1, A2, and A3, taxpayers must round

Purpose of Schedule

amounts to the nearest whole dollar. If 50 cents or more, round

up to the next dollar. If less than 50 cents, round down.

For taxable years beginning from and after December 31,

2013, a multistate service provider may elect to treat sales

Specific Instructions

from services as being in Arizona based on a combination of

income producing activity sales and market sales prescribed

Complete the name and taxpayer identification number section at

under Arizona Revised Statutes (A.R.S.) § 43-1147. The

the top of the form. Indicate the period covered by the taxable year.

election is effective retroactively for the entire taxable year on

Include the completed schedule with the tax return.

which the election is made. The election is binding on the

All returns, statements, and other documents filed with the

taxpayer for at least five consecutive taxable years beginning

department require a TIN. Organizations that fail to include

with the first taxable year to which the election applies,

their TIN may be subject to a penalty. Paid tax return

regardless of whether the taxpayer no longer meets the

preparers must include their TIN where requested. The TIN

percentage threshold of a multistate service provider during

for a paid tax return preparer is the individual's social security

that time period. To continue with the election after the five

number or the EIN of the business. Paid tax return preparers

consecutive taxable years, the taxpayer must meet the

that fail to include their TIN may be subject to a penalty.

qualifications to be considered a multistate service provider

and renew the election for another five consecutive taxable

Initial year of this election cycle. Enter the period the

election is initially made.

years.

Indicate year of election cycle. Indicate which year you are

Complete Schedule MSP, Part A, in the first year of the

in this election cycle. Check the applicable box.

election cycle to determine if you qualify to be treated as a

multistate service provider and to make the election. Complete

Part A – Multistate Service Provider Qualification

Part B in each taxable year of the election cycle to compute

the sales from services in Arizona.

Complete Part A only in the first year of each election cycle.

Do not round amounts in Part A.

Who Should File

Line A1 – Sales from Services with the Benefit of the

Taxpayers who want to make an election to be treated as a

Services Received Outside Arizona

multistate service provider under A.R.S. § 43-1147 must file

this schedule with the current tax year.

Enter sales from services provided to purchasers who receive

the benefit of the service outside Arizona in the taxable year of

NOTE: By completing and including Schedule MSP with the

election. Include sales made by all members who are required

current tax return, taxpayer is making an irrevocable election

to file a combined report and all members of an affiliated

pursuant to A.R.S. § 43-1147(B). This election is binding for

group included in a consolidated return. Exclude sales to

five consecutive taxable years beginning with the first taxable

students receiving educational services at campuses physically

year to which the election applies.

located in Arizona. Sales to students receiving educational

When to File

services means tuition and fees required for enrollment and

fees required for courses of instruction, transcripts, and

The election must be made on the taxpayer’s timely filed

graduation.

original income tax return including extensions. The taxpayer

must include the completed Schedule MSP with the tax return

Line A2 – Total Sales Everywhere (Including Sales

for the year when election is made and also in the four

from Services)

subsequent taxable years that the taxpayer is bound by the

Enter total sales (including sales from services) both inside

election after the expiration

election. To continue with the

and outside Arizona.

Exclude sales to students receiving

of the five consecutive taxable years, the taxpayer must meet

educational services at campuses physically located in

the qualification to be considered a multistate service provider

Arizona. Sales to students receiving educational services

and renew the election for another five consecutive taxable

means tuition and fees required for enrollment and fees

years by completing and including this schedule with the

required for courses of instruction, transcripts, and graduation.

timely filed tax return.

In general, total sales everywhere on line A2 is the same as

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2