Form Sc Sch.tc-40 - South Carolina Ethanol Or Biodiesel Production Credit

ADVERTISEMENT

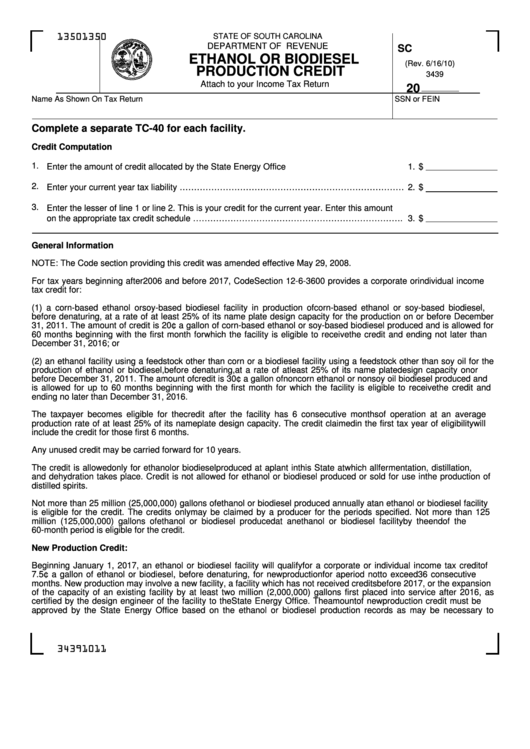

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

SC SCH.TC-40

ETHANOL OR BIODIESEL

(Rev. 6/16/10)

PRODUCTION CREDIT

3439

Attach to your Income Tax Return

20

Name As Shown On Tax Return

SSN or FEIN

Complete a separate TC-40 for each facility.

Credit Computation

1.

Enter the amount of credit allocated by the State Energy Office ...............................................

1.

$

2.

Enter your current year tax liability ……………………………………………………………………

2.

$

3.

Enter the lesser of line 1 or line 2. This is your credit for the current year. Enter this amount

on the appropriate tax credit schedule ……………………………………………………………….

3.

$

General Information

NOTE: The Code section providing this credit was amended effective May 29, 2008.

For tax years beginning after 2006 and before 2017, Code Section 12-6-3600 provides a corporate or individual income

tax credit for:

(1) a corn-based ethanol or soy-based biodiesel facility in production of corn-based ethanol or soy-based biodiesel,

before denaturing, at a rate of at least 25% of its name plate design capacity for the production on or before December

31, 2011. The amount of credit is 20¢ a gallon of corn-based ethanol or soy-based biodiesel produced and is allowed for

60 months beginning with the first month for which the facility is eligible to receive the credit and ending not later than

December 31, 2016; or

(2) an ethanol facility using a feedstock other than corn or a biodiesel facility using a feedstock other than soy oil for the

production of ethanol or biodiesel, before denaturing, at a rate of at least 25% of its name plate design capacity on or

before December 31, 2011. The amount of credit is 30¢ a gallon of noncorn ethanol or nonsoy oil biodiesel produced and

is allowed for up to 60 months beginning with the first month for which the facility is eligible to receive the credit and

ending no later than December 31, 2016.

The taxpayer becomes eligible for the credit after the facility has 6 consecutive months of operation at an average

production rate of at least 25% of its name plate design capacity. The credit claimed in the first tax year of eligibility will

include the credit for those first 6 months.

Any unused credit may be carried forward for 10 years.

The credit is allowed only for ethanol or biodiesel produced at a plant in this State at which all fermentation, distillation,

and dehydration takes place. Credit is not allowed for ethanol or biodiesel produced or sold for use in the production of

distilled spirits.

Not more than 25 million (25,000,000) gallons of ethanol or biodiesel produced annually at an ethanol or biodiesel facility

is eligible for the credit. The credits only may be claimed by a producer for the periods specified. Not more than 125

million (125,000,000) gallons of ethanol or biodiesel produced at an ethanol or biodiesel facility by the end of the

60-month period is eligible for the credit.

New Production Credit:

Beginning January 1, 2017, an ethanol or biodiesel facility will qualify for a corporate or individual income tax credit of

7.5¢ a gallon of ethanol or biodiesel, before denaturing, for new production for a period not to exceed 36 consecutive

months. New production may involve a new facility, a facility which has not received credits before 2017, or the expansion

of the capacity of an existing facility by at least two million (2,000,000) gallons first placed into service after 2016, as

certified by the design engineer of the facility to the State Energy Office. The amount of new production credit must be

approved by the State Energy Office based on the ethanol or biodiesel production records as may be necessary to

34391011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2