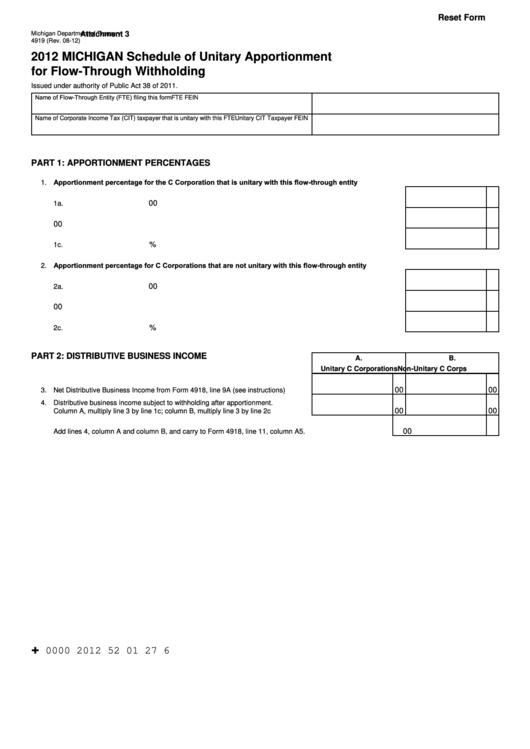

Reset Form

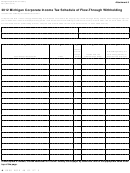

Michigan Department of Treasury

Attachment 3

4919 (Rev. 08-12)

2012 MICHIGAN Schedule of unitary Apportionment

for Flow-Through Withholding

Issued under authority of Public Act 38 of 2011.

Name of Flow-Through Entity (FTE) filing this form

FTE FEIN

Name of Corporate Income Tax (CIT) taxpayer that is unitary with this FTE

Unitary CIT Taxpayer FEIN

PART 1: APPORTIONMENT PERCENTAGES

1. Apportionment percentage for the C Corporation that is unitary with this flow-through entity

00

a. Michigan sales .............................................................................................................................................

1a.

00

b. Total sales....................................................................................................................................................

1b.

%

c. Apportionment percentage. Divide line 1a by line 1b ..................................................................................

1c.

2. Apportionment percentage for C Corporations that are not unitary with this flow-through entity

00

a. Michigan sales .............................................................................................................................................

2a.

00

b. Total sales....................................................................................................................................................

2b.

%

c. Apportionment percentage. Divide line 2a by line 2b ..................................................................................

2c.

PART 2: DISTRIBuTIvE BuSINESS INCOME

A.

B.

unitary C Corporations

Non-unitary C Corps

00

00

3. Net Distributive Business Income from Form 4918, line 9A (see instructions) ....

3.

4. Distributive business income subject to withholding after apportionment.

00

00

Column A, multiply line 3 by line 1c; column B, multiply line 3 by line 2c ............

4.

5. Total distributive business income subject to withholding for C corporations.

00

Add lines 4, column A and column B, and carry to Form 4918, line 11, column A ........................................

5.

+

0000 2012 52 01 27 6

1

1 2

2 3

3 4

4