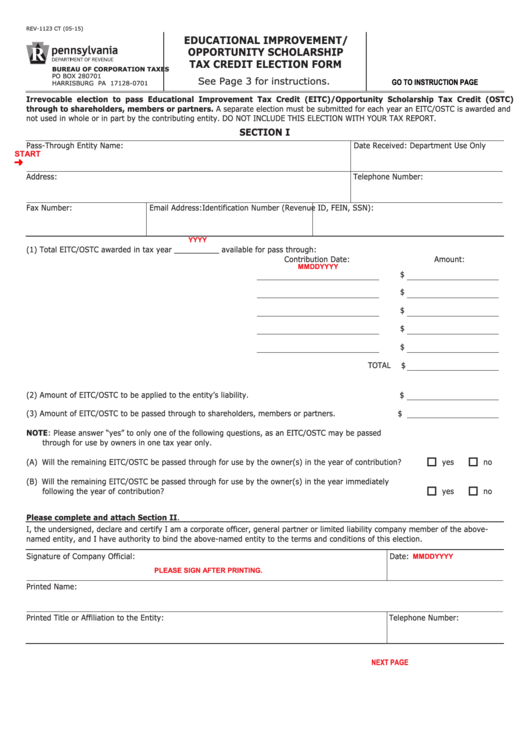

REV-1123 CT (05-15)

eDUCAtIoNAL IMPRoVeMeNt/

oPPoRtUNItY SCHoLARSHIP

tAX CReDIt eLeCtIoN FoRM

BUReAU oF CoRPoRAtIoN tAXeS

PO BOx 280701

See Page 3 for instructions.

GO TO INSTRUCTION PAGE

hARRISBuRg PA 17128-0701

Irrevocable election to pass educational Improvement tax Credit (eItC)/opportunity Scholarship tax Credit (oStC)

through to shareholders, members or partners. A separate election must be submitted for each year an EITC/OSTC is awarded and

not used in whole or in part by the contributing entity. DO NOT INCLuDE ThIS ELECTION WITh yOuR TAx REPORT.

SeCtIoN I

Pass-Through Entity Name:

Date Received: Department use Only

START

Address:

Telephone Number:

Fax Number:

Email Address:

Identification Number (Revenue ID, FEIN, SSN):

YYYY

(1) Total EITC/OSTC awarded in tax year __________ available for pass through:

Contribution Date:

Amount:

MMDDYYYY

$

$

$

$

$

TOTAL

$

(2) Amount of EITC/OSTC to be applied to the entity’s liability.

$

(3) Amount of EITC/OSTC to be passed through to shareholders, members or partners.

$

Note: Please answer “yes” to only one of the following questions, as an EITC/OSTC may be passed

through for use by owners in one tax year only.

(A) Will the remaining EITC/OSTC be passed through for use by the owner(s) in the year of contribution?

yes

no

(B) Will the remaining EITC/OSTC be passed through for use by the owner(s) in the year immediately

following the year of contribution?

yes

no

Please complete and attach Section II.

I, the undersigned, declare and certify I am a corporate officer, general partner or limited liability company member of the above-

named entity, and I have authority to bind the above-named entity to the terms and conditions of this election.

Signature of Company Official:

Date:

MMDDYYYY

PLEASE SIGN AFTER PRINTING.

Printed Name:

Printed Title or Affiliation to the Entity:

Telephone Number:

Reset Entire Form

NEXT PAGE

PRINT FORM

1

1 2

2 3

3