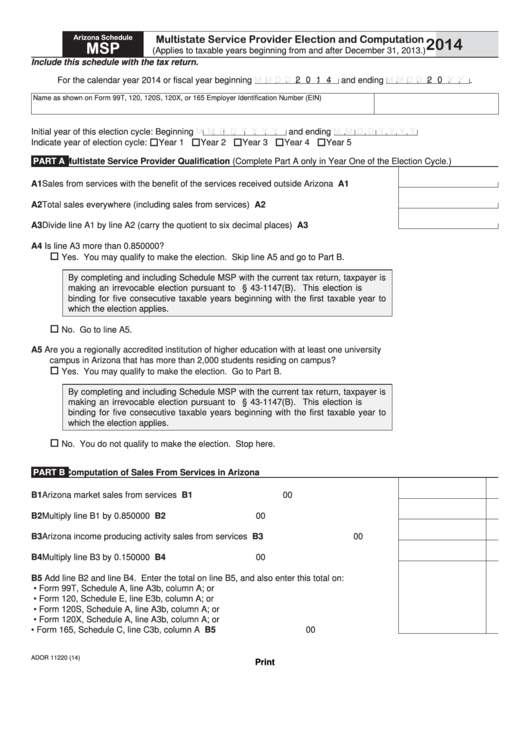

Multistate Service Provider Election and Computation

Arizona Schedule

2014

MSP

(Applies to taxable years beginning from and after December 31, 2013.)

Include this schedule with the tax return.

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

For the calendar year 2014 or fiscal year beginning

.

Name as shown on Form 99T, 120, 120S, 120X, or 165

Employer Identification Number (EIN)

Initial year of this election cycle:

Beginning

M M D D Y Y Y Y

and ending

M M D D Y Y Y Y

Indicate year of election cycle:

Year 1

Year 2

Year 3

Year 4

Year 5

PART A

Multistate Service Provider Qualification (Complete Part A only in Year One of the Election Cycle.)

A1 Sales from services with the benefit of the services received outside Arizona ................ A1

A2 Total sales everywhere (including sales from services) ................................................... A2

A3 Divide line A1 by line A2 (carry the quotient to six decimal places) ................................. A3

A4 Is line A3 more than 0.850000?

Yes. You may qualify to make the election. Skip line A5 and go to Part B.

By completing and including Schedule MSP with the current tax return, taxpayer is

making an irrevocable election pursuant to A.R.S. § 43-1147(B). This election is

binding for five consecutive taxable years beginning with the first taxable year to

which the election applies.

No. Go to line A5.

A5 Are you a regionally accredited institution of higher education with at least one university

campus in Arizona that has more than 2,000 students residing on campus?

Yes. You may qualify to make the election. Go to Part B.

By completing and including Schedule MSP with the current tax return, taxpayer is

making an irrevocable election pursuant to A.R.S. § 43-1147(B). This election is

binding for five consecutive taxable years beginning with the first taxable year to

which the election applies.

No. You do not qualify to make the election. Stop here.

PART B

Computation of Sales From Services in Arizona

B1 Arizona market sales from services ................................................................................. B1

00

B2 Multiply line B1 by 0.850000 ............................................................................................ B2

00

B3 Arizona income producing activity sales from services ................................................... B3

00

B4 Multiply line B3 by 0.150000 ............................................................................................ B4

00

B5 Add line B2 and line B4. Enter the total on line B5, and also enter this total on:

• Form 99T, Schedule A, line A3b, column A; or

• Form 120, Schedule E, line E3b, column A; or

• Form 120S, Schedule A, line A3b, column A; or

• Form 120X, Schedule A, line A3b, column A; or

• Form 165, Schedule C, line C3b, column A .................................................................. B5

00

ADOR 11220 (14)

Print

1

1