Form Sc Sch.tc-38 - South Carolina Solar Energy Or Small Hydropower System Credit

ADVERTISEMENT

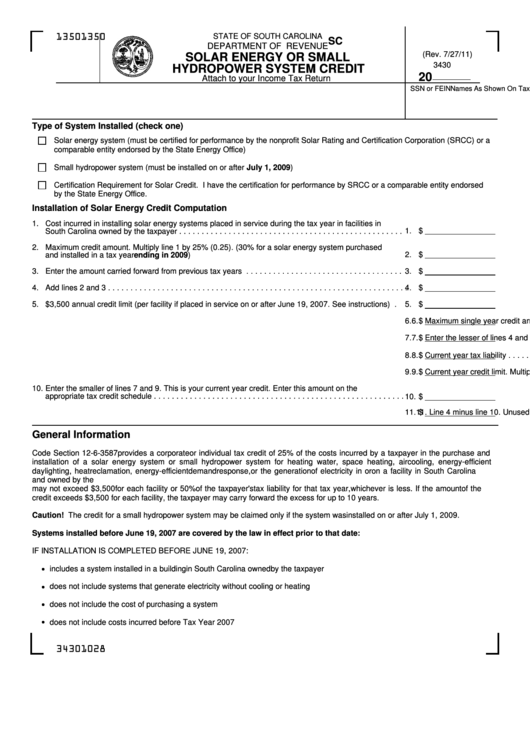

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-38

DEPARTMENT OF REVENUE

(Rev. 7/27/11)

SOLAR ENERGY OR SMALL

3430

HYDROPOWER SYSTEM CREDIT

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SSN or FEIN

Type of System Installed (check one)

Solar energy system (must be certified for performance by the nonprofit Solar Rating and Certification Corporation (SRCC) or a

comparable entity endorsed by the State Energy Office)

Small hydropower system (must be installed on or after July 1, 2009)

Certification Requirement for Solar Credit. I have the certification for performance by SRCC or a comparable entity endorsed

by the State Energy Office.

Installation of Solar Energy Credit Computation

1. Cost incurred in installing solar energy systems placed in service during the tax year in facilities in

1.

$

South Carolina owned by the taxpayer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Maximum credit amount. Multiply line 1 by 25% (0.25). (30% for a solar energy system purchased

2.

$

and installed in a tax year ending in 2009) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Enter the amount carried forward from previous tax years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

$

4. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

$

5. $3,500 annual credit limit (per facility if placed in service on or after June 19, 2007. See instructions) .

5.

$

6. Maximum single year credit amount. Multiply line 5 by the number of facilities . . . . . . . . . . . . . . . . . . .

6.

$

7. Enter the lesser of lines 4 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

$

8. Current year tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

$

9. Current year credit limit. Multiply line 8 by 50% (0.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

$

10. Enter the smaller of lines 7 and 9. This is your current year credit. Enter this amount on the

appropriate tax credit schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

$

11. Line 4 minus line 10. Unused credits may be carried forward for up to 10 years . . . . . . . . . . . . . . . . . .

11.

$

General Information

Code Section 12-6-3587 provides a corporate or individual tax credit of 25% of the costs incurred by a taxpayer in the purchase and

installation of a solar energy system or small hydropower system for heating water, space heating, air cooling, energy-efficient

daylighting, heat reclamation, energy-efficient demand response, or the generation of electricity in or on a facility in South Carolina

and owned by the taxpayer. The taxpayer may not claim the credit before installation is complete. The amount of the credit in any year

may not exceed $3,500 for each facility or 50% of the taxpayer's tax liability for that tax year, whichever is less. If the amount of the

credit exceeds $3,500 for each facility, the taxpayer may carry forward the excess for up to 10 years.

Caution! The credit for a small hydropower system may be claimed only if the system was installed on or after July 1, 2009.

Systems installed before June 19, 2007 are covered by the law in effect prior to that date:

IF INSTALLATION IS COMPLETED BEFORE JUNE 19, 2007:

includes a system installed in a building in South Carolina owned by the taxpayer

does not include systems that generate electricity without cooling or heating

does not include the cost of purchasing a system

does not include costs incurred before Tax Year 2007

34301028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2