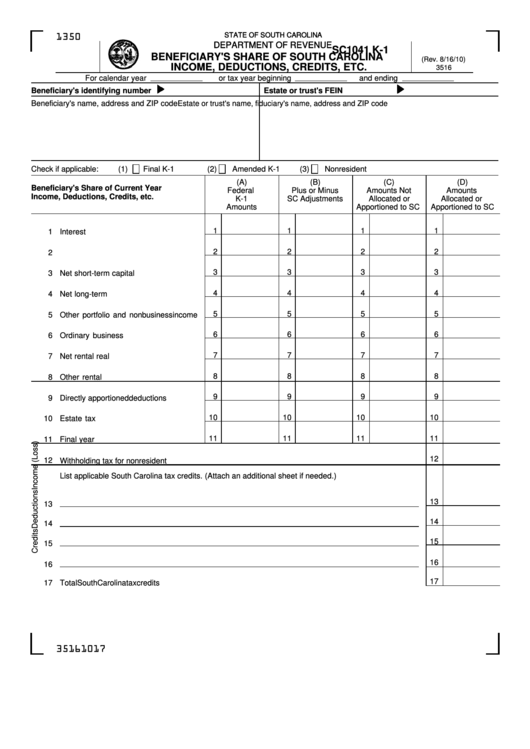

Form Sc1041 K-1 - South Carolina Beneficiary'S Share Of South Carolina Income, Deductions, Credits, Etc.

ADVERTISEMENT

STATE OF SOUTH CAROLINA

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

DEPARTMENT OF REVENUE

SC1041 K-1

BENEFICIARY'S SHARE OF SOUTH CAROLINA

(Rev. 8/16/10)

INCOME, DEDUCTIONS, CREDITS, ETC.

3516

For calendar year

or tax year beginning

and ending

Beneficiary's identifying number

Estate or trust's FEIN

Beneficiary's name, address and ZIP code

Estate or trust's name, fiduciary's name, address and ZIP code

Check if applicable:

(1)

Final K-1

(2)

Amended K-1

(3)

Nonresident

(A)

(B)

(C)

(D)

Beneficiary's Share of Current Year

Federal

Plus or Minus

Amounts Not

Amounts

Income, Deductions, Credits, etc.

K-1

SC Adjustments

Allocated or

Allocated or

Amounts

Apportioned to SC

Apportioned to SC

1

1

1

1

1

Interest income........................................

2

2

2

2

2

Dividends.................................................

3

3

3

3

3

Net short-term capital gain.......................

4

4

4

4

4

Net long-term capital gain........................

5

5

5

5

5

Other portfolio and nonbusiness income

6

6

6

6

6

Ordinary business income.......................

7

7

7

7

7

Net rental real estate income...................

8

8

8

8

8

Other rental income.................................

9

9

9

9

9

Directly apportioned deductions ..............

10

10

10

10

10

Estate tax deduction................................

11

11

11

11

11

Final year deductions...............................

12

12

Withholding tax for nonresident beneficiary.................................................................................................

List applicable South Carolina tax credits. (Attach an additional sheet if needed.)

13

13

14

14

15

15

16

16

17

17

Total South Carolina tax credits ..................................................................................................................

35161017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2