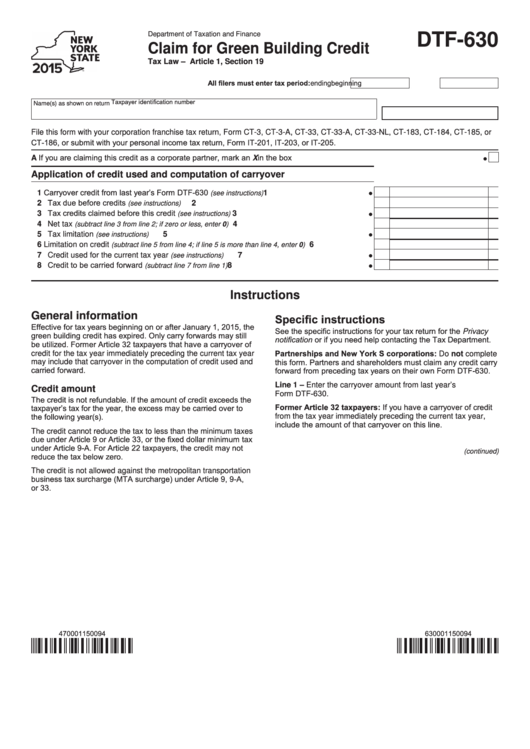

Department of Taxation and Finance

DTF-630

Claim for Green Building Credit

Tax Law – Article 1, Section 19

All filers must enter tax period:

beginning

ending

Taxpayer identification number

Name(s) as shown on return

File this form with your corporation franchise tax return, Form CT-3, CT-3-A, CT-33, CT-33-A, CT-33-NL, CT-183, CT-184, CT-185, or

CT-186, or submit with your personal income tax return, Form IT-201, IT-203, or IT-205.

A If you are claiming this credit as a corporate partner, mark an X in the box .....................................................................................

Application of credit used and computation of carryover

1 Carryover credit from last year’s Form DTF-630

..............................................

1

(see instructions)

2 Tax due before credits

........................................................................................

2

(see instructions)

3 Tax credits claimed before this credit

...............................................................

3

(see instructions)

..................................................................

4 Net tax

4

(subtract line 3 from line 2; if zero or less, enter 0)

.....................................................................................................

5 Tax limitation

5

(see instructions)

.............................

6 Limitation on credit

6

(subtract line 5 from line 4; if line 5 is more than line 4, enter 0)

..................................................................

7 Credit used for the current tax year

7

(see instructions)

8 Credit to be carried forward

................................................................

8

(subtract line 7 from line 1)

Instructions

General information

Specific instructions

Effective for tax years beginning on or after January 1, 2015, the

See the specific instructions for your tax return for the Privacy

green building credit has expired. Only carry forwards may still

notification or if you need help contacting the Tax Department.

be utilized. Former Article 32 taxpayers that have a carryover of

Partnerships and New York S corporations: Do not complete

credit for the tax year immediately preceding the current tax year

this form. Partners and shareholders must claim any credit carry

may include that carryover in the computation of credit used and

carried forward.

forward from preceding tax years on their own Form DTF-630.

Line 1 – Enter the carryover amount from last year’s

Credit amount

Form DTF-630.

The credit is not refundable. If the amount of credit exceeds the

Former Article 32 taxpayers: If you have a carryover of credit

taxpayer’s tax for the year, the excess may be carried over to

the following year(s).

from the tax year immediately preceding the current tax year,

include the amount of that carryover on this line.

The credit cannot reduce the tax to less than the minimum taxes

due under Article 9 or Article 33, or the fixed dollar minimum tax

under Article 9-A. For Article 22 taxpayers, the credit may not

(continued)

reduce the tax below zero.

The credit is not allowed against the metropolitan transportation

business tax surcharge (MTA surcharge) under Article 9, 9-A,

or 33.

470001150094

630001150094

1

1 2

2