Clear Form

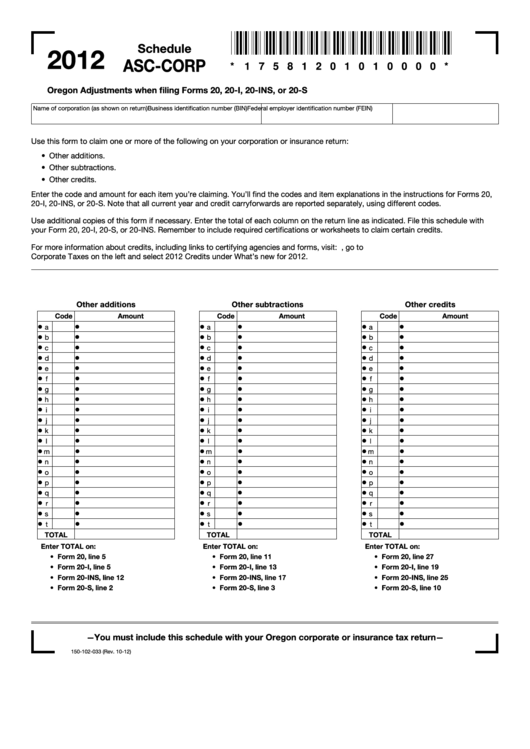

Schedule

2012

ASC-CORP

* 1 7 5 8 1 2 0 1 0 1 0 0 0 0 *

Oregon Adjustments when filing Forms 20, 20-I, 20-INS, or 20-S

Name of corporation (as shown on return)

Federal employer identification number (FEIN)

Business identification number (BIN)

Use this form to claim one or more of the following on your corporation or insurance return:

• Other additions.

• Other subtractions.

• Other credits.

Enter the code and amount for each item you’re claiming. You’ll find the codes and item explanations in the instructions for Forms 20,

20-I, 20-INS, or 20-S. Note that all current year and credit carryforwards are reported separately, using different codes.

Use additional copies of this form if necessary. Enter the total of each column on the return line as indicated. File this schedule with

your Form 20, 20-I, 20-S, or 20-INS. Remember to include required certifications or worksheets to claim certain credits.

For more information about credits, including links to certifying agencies and forms, visit: , go to

Corporate Taxes on the left and select 2012 Credits under What’s new for 2012.

Other additions

Other subtractions

Other credits

Code

Amount

Code

Amount

Code

Amount

•

•

•

•

•

•

a

a

a

•

•

•

•

•

•

b

b

b

•

•

•

•

•

•

c

c

c

•

•

•

•

•

•

d

d

d

•

•

•

•

•

•

e

e

e

•

•

•

•

•

•

f

f

f

•

•

•

•

•

•

g

g

g

•

•

•

•

•

•

h

h

h

•

•

•

•

•

•

i

i

i

•

•

•

•

•

•

j

j

j

•

•

•

•

•

•

k

k

k

•

•

•

•

•

•

l

l

l

•

•

•

•

•

•

m

m

m

•

•

•

•

•

•

n

n

n

•

•

•

•

•

•

o

o

o

•

•

•

•

•

•

p

p

p

•

•

•

•

•

•

q

q

q

•

•

•

•

•

•

r

r

r

•

•

•

•

•

•

s

s

s

•

•

•

•

•

•

t

t

t

TOTAL

TOTAL

TOTAL

Enter TOTAL on:

Enter TOTAL on:

Enter TOTAL on:

• Form 20, line 5

• Form 20, line 11

• Form 20, line 27

• Form 20-I, line 5

• Form 20-I, line 13

• Form 20-I, line 19

• Form 20-INS, line 12

• Form 20-INS, line 17

• Form 20-INS, line 25

• Form 20-S, line 2

• Form 20-S, line 3

• Form 20-S, line 10

You must include this schedule with your Oregon corporate or insurance tax return

—

—

150-102-033 (Rev. 10-12)

1

1