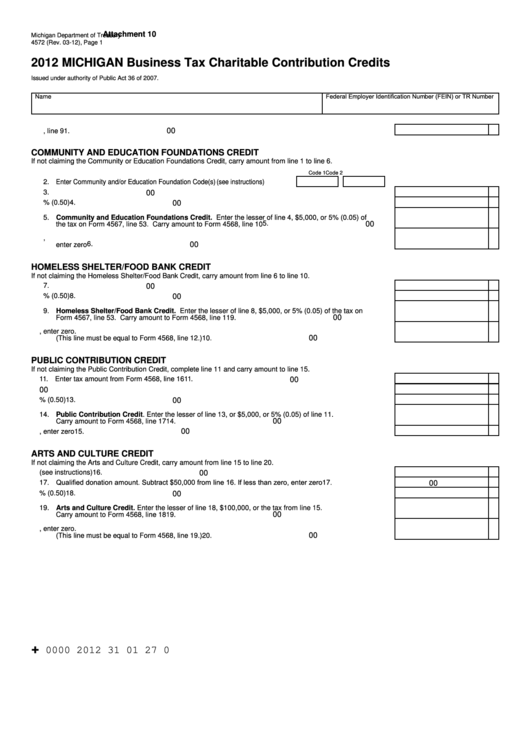

Form 4572 - Michigan Business Tax Charitable Contribution Credits - 2012

ADVERTISEMENT

Attachment 10

Michigan Department of Treasury

4572 (Rev. 03-12), Page 1

2012 MICHIGAN Business Tax Charitable Contribution Credits

Issued under authority of Public Act 36 of 2007.

Federal Employer Identification Number (FEIN) or TR Number

Name

00

1. Tax liability prior to this credit from Form 4568, line 9 .................................................................................

1.

COMMUNITY AND EDUCATION FOUNDATIONS CREDIT

If not claiming the Community or Education Foundations Credit, carry amount from line 1 to line 6.

Code 1

Code 2

2. Enter Community and/or Education Foundation Code(s) (see instructions) ........ 2.

3. Community and Education Foundations donation amount ..........................................................................

3.

00

4. Multiply line 3 by 50% (0.50) .......................................................................................................................

4.

00

5. Community and Education Foundations Credit. Enter the lesser of line 4, $5,000, or 5% (0.05) of

5.

00

the tax on Form 4567, line 53. Carry amount to Form 4568, line 10 ..........................................................

6. Tax After Community and Education Foundations Credit. Subtract line 5 from line 1. If less than zero,

6.

00

enter zero ...................................................................................................................................................

HOMELESS SHELTER/FOOD BANK CREDIT

If not claiming the Homeless Shelter/Food Bank Credit, carry amount from line 6 to line 10.

7. Homeless Shelter/Food Bank cash donation amount .................................................................................

7.

00

8. Multiply line 7 by 50% (0.50) .......................................................................................................................

8.

00

9. Homeless Shelter/Food Bank Credit. Enter the lesser of line 8, $5,000, or 5% (0.05) of the tax on

00

Form 4567, line 53. Carry amount to Form 4568, line 11 ...........................................................................

9.

10. Tax After Homeless Shelter/Food Bank Credit. Subtract line 9 from line 6. If less than zero, enter zero.

00

(This line must be equal to Form 4568, line 12.) .........................................................................................

10.

PUBLIC CONTRIBUTION CREDIT

If not claiming the Public Contribution Credit, complete line 11 and carry amount to line 15.

11. Enter tax amount from Form 4568, line 16 ..................................................................................................

11.

00

12. Public Contribution donation amount...........................................................................................................

12.

00

13. Multiply line 12 by 50% (0.50) .....................................................................................................................

13.

00

14. Public Contribution Credit. Enter the lesser of line 13, or $5,000, or 5% (0.05) of line 11.

00

Carry amount to Form 4568, line 17 ............................................................................................................

14.

00

15. Tax After Public Contribution Credit. Subtract line 14 from line 11. If less than zero, enter zero ................

15.

ARTS AND CULTURE CREDIT

If not claiming the Arts and Culture Credit, carry amount from line 15 to line 20.

16. Arts and Culture donation amount (see instructions) ..................................................................................

16.

00

17. Qualified donation amount. Subtract $50,000 from line 16. If less than zero, enter zero ............................

17.

00

18. Multiply line 17 by 50% (0.50) .....................................................................................................................

18.

00

19. Arts and Culture Credit. Enter the lesser of line 18, $100,000, or the tax from line 15.

00

Carry amount to Form 4568, line 18 ............................................................................................................

19.

20. Tax After Arts and Culture Credit. Subtract line 19 from line 15. If less than zero, enter zero.

00

(This line must be equal to Form 4568, line 19.) .........................................................................................

20.

+

0000 2012 31 01 27 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2