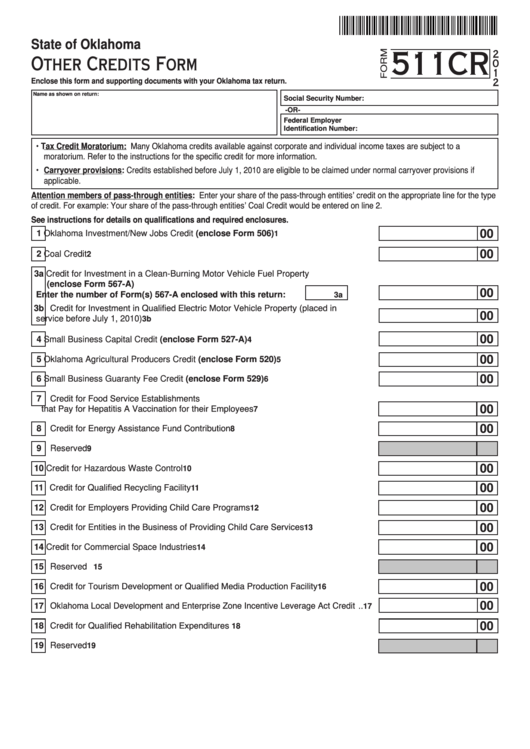

State of Oklahoma

511CR

2

Other Credits Form

0

1

2

Enclose this form and supporting documents with your Oklahoma tax return.

Name as shown on return:

Social Security Number:

-OR-

Federal Employer

Identification Number:

• Tax Credit Moratorium: Many Oklahoma credits available against corporate and individual income taxes are subject to a

moratorium. Refer to the instructions for the specific credit for more information.

• Carryover provisions: Credits established before July 1, 2010 are eligible to be claimed under normal carryover provisions if

applicable.

Attention members of pass-through entities: Enter your share of the pass-through entities’ credit on the appropriate line for the type

of credit. For example: Your share of the pass-through entities’ Coal Credit would be entered on line 2.

See instructions for details on qualifications and required enclosures.

00

1 Oklahoma Investment/New Jobs Credit (enclose Form 506) ...................................

1

00

2 Coal Credit ..................................................................................................................

2

3a Credit for Investment in a Clean-Burning Motor Vehicle Fuel Property

(enclose Form 567-A)

00

Enter the number of Form(s) 567-A enclosed with this return:

.....

3a

3b Credit for Investment in Qualified Electric Motor Vehicle Property (placed in

00

service before July 1, 2010) .....................................................................................

3b

00

4 Small Business Capital Credit (enclose Form 527-A) ...............................................

4

00

5 Oklahoma Agricultural Producers Credit (enclose Form 520) ...................................

5

00

6 Small Business Guaranty Fee Credit (enclose Form 529) ........................................

6

7 Credit for Food Service Establishments

that Pay for Hepatitis A Vaccination for their Employees ............................................

00

7

8 Credit for Energy Assistance Fund Contribution .........................................................

00

8

9 Reserved ....................................................................................................................

9

00

10 Credit for Hazardous Waste Control .........................................................................

10

11 Credit for Qualified Recycling Facility .......................................................................

00

11

12 Credit for Employers Providing Child Care Programs ..............................................

00

12

13 Credit for Entities in the Business of Providing Child Care Services ........................

00

13

00

14 Credit for Commercial Space Industries ...................................................................

14

15 Reserved .................................................................................................................

15

16 Credit for Tourism Development or Qualified Media Production Facility ..................

00

16

17 Oklahoma Local Development and Enterprise Zone Incentive Leverage Act Credit ..

00

17

18 Credit for Qualified Rehabilitation Expenditures ......................................................

00

18

19 Reserved ..................................................................................................................

19

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11