Clear Form

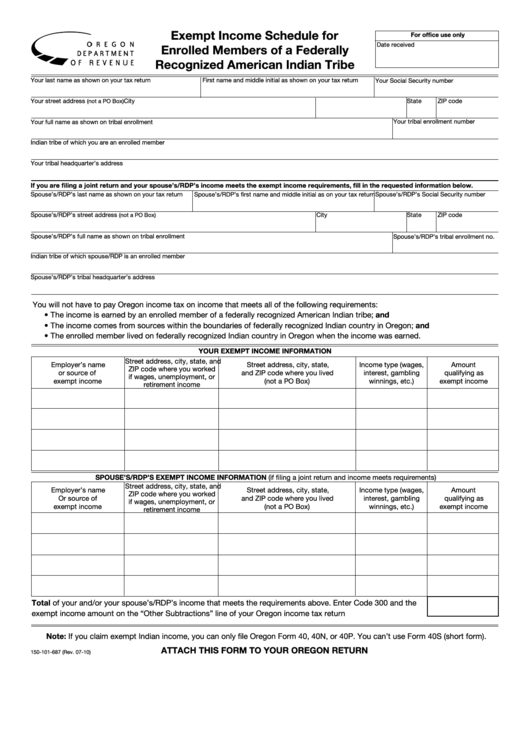

Exempt Income Schedule for

For office use only

Date received

Enrolled Members of a Federally

Recognized American Indian Tribe

Your last name as shown on your tax return

First name and middle initial as shown on your tax return

Your Social Security number

Your street address

City

State

ZIP code

(not a PO Box)

Your tribal enrollment number

Your full name as shown on tribal enrollment

Indian tribe of which you are an enrolled member

Your tribal headquarter’s address

If you are filing a joint return and your spouse’s/RDP’s income meets the exempt income requirements, fill in the requested information below.

Spouse’s/RDP’s last name as shown on your tax return

Spouse’s/RDP’s first name and middle initial as on your tax return

Spouse’s/RDP’s Social Security number

Spouse’s/RDP’s street address

(not a PO Box)

City

State

ZIP code

Spouse’s/RDP’s full name as shown on tribal enrollment

Spouse’s/RDP’s tribal enrollment no.

Indian tribe of which spouse/RDP is an enrolled member

Spouse’s/RDP’s tribal headquarter’s address

You will not have to pay Oregon income tax on income that meets all of the following requirements:

• The income is earned by an enrolled member of a federally recognized American Indian tribe; and

• The income comes from sources within the boundaries of federally recognized Indian country in Oregon; and

• The enrolled member lived on federally recognized Indian country in Oregon when the income was earned.

YOUR EXEMPT INCOME INFORMATION

Street address, city, state, and

Employer’s name

Street address, city, state,

Income type (wages,

Amount

ZIP code where you worked

or source of

and ZIP code where you lived

interest, gambling

qualifying as

if wages, unemployment, or

exempt income

(not a PO Box)

winnings, etc.)

exempt income

retirement income

SPOUSE’S/RDP’S EXEMPT INCOME INFORMATION (if filing a joint return and income meets requirements)

Street address, city, state, and

Employer’s name

Street address, city, state,

Income type (wages,

Amount

ZIP code where you worked

Or source of

and ZIP code where you lived

interest, gambling

qualifying as

if wages, unemployment, or

winnings, etc.)

exempt income

(not a PO Box)

exempt income

retirement income

Total of your and/or your spouse’s/RDP’s income that meets the requirements above. Enter Code 300 and the

exempt income amount on the “Other Subtractions” line of your Oregon income tax return ....................................

Note: If you claim exempt Indian income, you can only file Oregon Form 40, 40N, or 40P. You can’t use Form 40S (short form).

ATTACH THIS FORM TO YOUR OREGON RETURN

150-101-687 (Rev. 07-10)

1

1 2

2