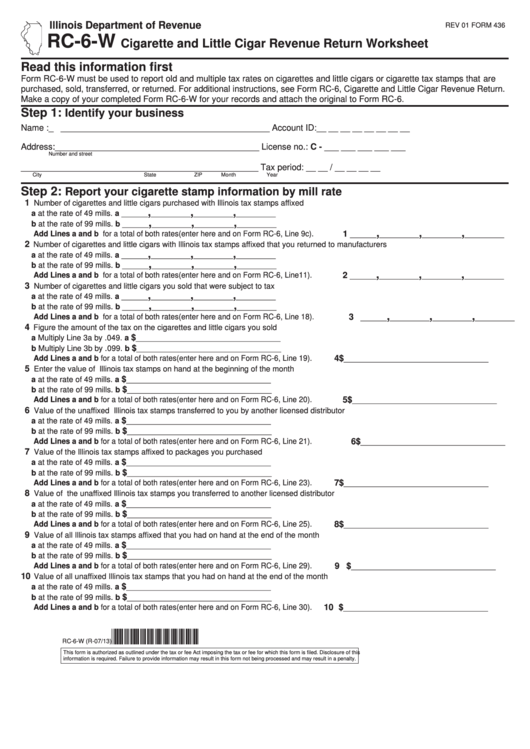

Illinois Department of Revenue

REV 01 FORM 436

RC-6-W

Cigarette and Little Cigar Revenue Return Worksheet

Read this information first

Form RC-6-W must be used to report old and multiple tax rates on cigarettes and little cigars or cigarette tax stamps that are

purchased, sold, transferred, or returned. For additional instructions, see Form RC-6, Cigarette and Little Cigar Revenue Return.

Make a copy of your completed Form RC-6-W for your records and attach the original to Form RC-6.

Step 1:

Identify your business

Name :_ ____________________________________________ Account ID:__ __ __ __ __ __ __ __

Address:___________________________________________ License no.: C - ___ ___ ___ ___ ___

Number and street

__________________________________________________ Tax period: __ __ / __ __ __ __

City

State

ZIP

Month

Year

Step 2:

Report your cigarette stamp information by mill rate

1

Number of cigarettes and little cigars purchased with Illinois tax stamps affixed

,

,

,

a at the rate of 49 mills.

a ______

_________

_________

_________

,

,

,

b at the rate of 99 mills.

b ______

_________

_________

_________

,

,

,

1

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 9c).

______

_________

_________

_________

2

Number of cigarettes and little cigars with Illinois tax stamps affixed that you returned to manufacturers

,

,

,

a at the rate of 49 mills.

a ______

_________

_________

_________

,

,

,

b at the rate of 99 mills.

b ______

_________

_________

_________

,

,

,

2

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line11).

______

_________

_________

_________

3

Number of cigarettes and little cigars you sold that were subject to tax

,

,

,

a at the rate of 49 mills.

a ______

_________

_________

_________

,

,

,

b at the rate of 99 mills.

b ______

_________

_________

_________

,

,

,

3

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 18).

______

_________

_________

_________

4

Figure the amount of the tax on the cigarettes and little cigars you sold

$

a Multiply Line 3a by .049.

a

_________________________________

$

b Multiply Line 3b by .099.

b

_________________________________

4 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 19).

_________________________________

5

Enter the value of Illinois tax stamps on hand at the beginning of the month

$

a at the rate of 49 mills.

a

_________________________________

$

b at the rate of 99 mills.

b

_________________________________

5 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 20).

_________________________________

6

Value of the unaffixed Illinois tax stamps transferred to you by another licensed distributor

$

a at the rate of 49 mills.

a

_________________________________

$

b at the rate of 99 mills.

b

_________________________________

6 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 21).

_________________________________

7

Value of the Illinois tax stamps affixed to packages you purchased

$

a at the rate of 49 mills.

a

_________________________________

$

b at the rate of 99 mills.

b

_________________________________

7 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 23).

_________________________________

8

Value of the unaffixed Illinois tax stamps you transferred to another licensed distributor

$

a at the rate of 49 mills.

a

_________________________________

$

b at the rate of 99 mills.

b

_________________________________

8 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 25).

_________________________________

9

Value of all Illinois tax stamps affixed that you had on hand at the end of the month

$

a at the rate of 49 mills.

a

_________________________________

$

b at the rate of 99 mills.

b

_________________________________

9 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 29).

_________________________________

10

Value of all unaffixed Illinois tax stamps that you had on hand at the end of the month

$

a at the rate of 49 mills.

a

_________________________________

$

b at the rate of 99 mills.

b

_________________________________

10 $

Add Lines a and b for a total of both rates (enter here and on Form RC-6, Line 30).

_________________________________

*343611110*

RC-6-W (R-07/13)

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

1

1 2

2