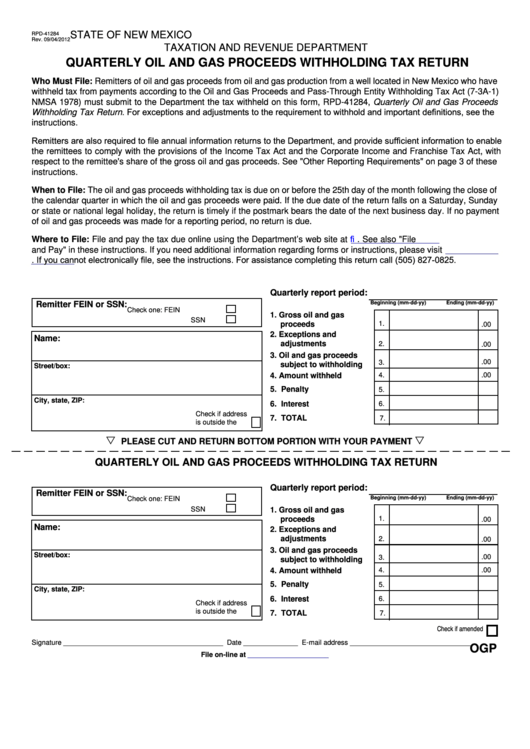

STATE OF NEW MEXICO

RPD-41284

Rev. 09/04/2012

TAXATION AND REVENUE DEPARTMENT

QUARTERLY OIL AND GAS PROCEEDS WITHHOLDING TAX RETURN

Who Must File: Remitters of oil and gas proceeds from oil and gas production from a well located in New Mexico who have

withheld tax from payments according to the Oil and Gas Proceeds and Pass-Through Entity Withholding Tax Act (7-3A-1)

NMSA 1978) must submit to the Department the tax withheld on this form, RPD-41284, Quarterly Oil and Gas Proceeds

Withholding Tax Return. For exceptions and adjustments to the requirement to withhold and important definitions, see the

instructions.

Remitters are also required to file annual information returns to the Department, and provide sufficient information to enable

the remittees to comply with the provisions of the Income Tax Act and the Corporate Income and Franchise Tax Act, with

respect to the remittee's share of the gross oil and gas proceeds. See "Other Reporting Requirements" on page 3 of these

instructions.

When to File: The oil and gas proceeds withholding tax is due on or before the 25th day of the month following the close of

the calendar quarter in which the oil and gas proceeds were paid. If the due date of the return falls on a Saturday, Sunday

or state or national legal holiday, the return is timely if the postmark bears the date of the next business day. If no payment

of oil and gas proceeds was made for a reporting period, no return is due.

Where to File: File and pay the tax due online using the Department’s web site at https://efile.state.nm.us. See also "File

and Pay" in these instructions. If you need additional information regarding forms or instructions, please visit

mexico.gov. If you cannot electronically file, see the instructions. For assistance completing this return call (505) 827-0825.

Quarterly report period:

Remitter FEIN or SSN:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

Check one:

FEIN

1. Gross oil and gas

SSN

1.

.00

proceeds

2. Exceptions and

Name:

2.

.00

adjustments

3. Oil and gas proceeds

3.

.00

subject to withholding

Street/box:

4.

.00

4. Amount withheld

5.

5. Penalty

City, state, ZIP:

6.

6. Interest

Check if address

7.

7. TOTAL

is outside the U.S.

PLEASE CUT AND RETURN BOTTOM PORTION WITH YOUR PAYMENT

QUARTERLY OIL AND GAS PROCEEDS WITHHOLDING TAX RETURN

Quarterly report period:

Remitter FEIN or SSN:

Check one:

FEIN

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

SSN

1. Gross oil and gas

1.

.00

proceeds

Name:

2. Exceptions and

2.

.00

adjustments

3. Oil and gas proceeds

Street/box:

.00

3.

subject to withholding

4.

.00

4. Amount withheld

5.

5. Penalty

City, state, ZIP:

6.

6. Interest

Check if address

is outside the U.S.

7.

7. TOTAL

Check if amended

Signature _________________________________________ Date ______________ E-mail address _______________________________

OGP

File on-line at

1

1 2

2 3

3 4

4 5

5