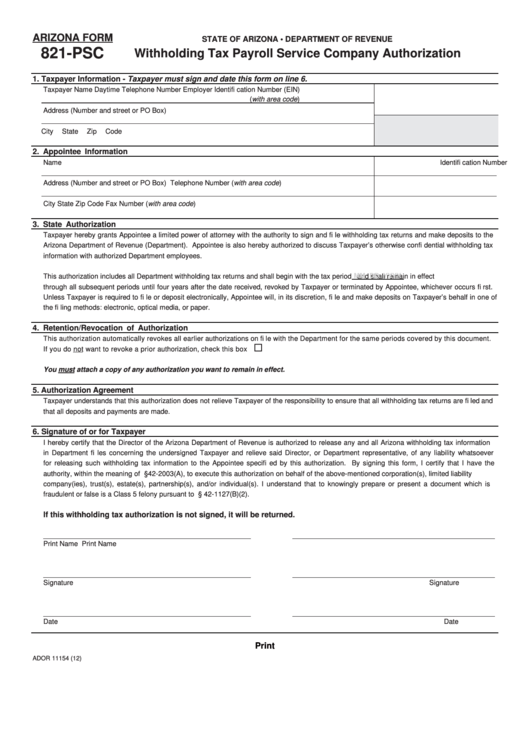

ARIZONA FORM

STATE OF ARIZONA • DEPARTMENT OF REVENUE

821-PSC

Withholding Tax Payroll Service Company Authorization

1. Taxpayer Information - Taxpayer must sign and date this form on line 6.

Taxpayer Name

Daytime Telephone Number

Employer Identifi cation Number (EIN)

(with area code)

Address (Number and street or PO Box)

City

State

Zip Code

2. Appointee Information

Name

Identifi cation Number

Address (Number and street or PO Box)

Telephone Number (with area code)

City

State

Zip Code

Fax Number (with area code)

3. State Authorization

Taxpayer hereby grants Appointee a limited power of attorney with the authority to sign and fi le withholding tax returns and make deposits to the

Arizona Department of Revenue (Department). Appointee is also hereby authorized to discuss Taxpayer’s otherwise confi dential withholding tax

information with authorized Department employees.

MM DD YYYY

This authorization includes all Department withholding tax returns and shall begin with the tax period

and shall remain in effect

through all subsequent periods until four years after the date received, revoked by Taxpayer or terminated by Appointee, whichever occurs fi rst.

Unless Taxpayer is required to fi le or deposit electronically, Appointee will, in its discretion, fi le and make deposits on Taxpayer’s behalf in one of

the fi ling methods: electronic, optical media, or paper.

4. Retention/Revocation of Authorization

This authorization automatically revokes all earlier authorizations on fi le with the Department for the same periods covered by this document.

If you do not want to revoke a prior authorization, check this box ..........................................................................................................

You must attach a copy of any authorization you want to remain in effect.

5. Authorization Agreement

Taxpayer understands that this authorization does not relieve Taxpayer of the responsibility to ensure that all withholding tax returns are fi led and

that all deposits and payments are made.

6. Signature of or for Taxpayer

I hereby certify that the Director of the Arizona Department of Revenue is authorized to release any and all Arizona withholding tax information

in Department fi les concerning the undersigned Taxpayer and relieve said Director, or Department representative, of any liability whatsoever

for releasing such withholding tax information to the Appointee specifi ed by this authorization. By signing this form, I certify that I have the

authority, within the meaning of A.R.S. §42-2003(A), to execute this authorization on behalf of the above-mentioned corporation(s), limited liability

company(ies), trust(s), estate(s), partnership(s), and/or individual(s). I understand that to knowingly prepare or present a document which is

fraudulent or false is a Class 5 felony pursuant to A.R.S. § 42-1127(B)(2).

If this withholding tax authorization is not signed, it will be returned.

Print Name

Print Name

Signature

Signature

Date

Date

Print

ADOR 11154 (12)

1

1