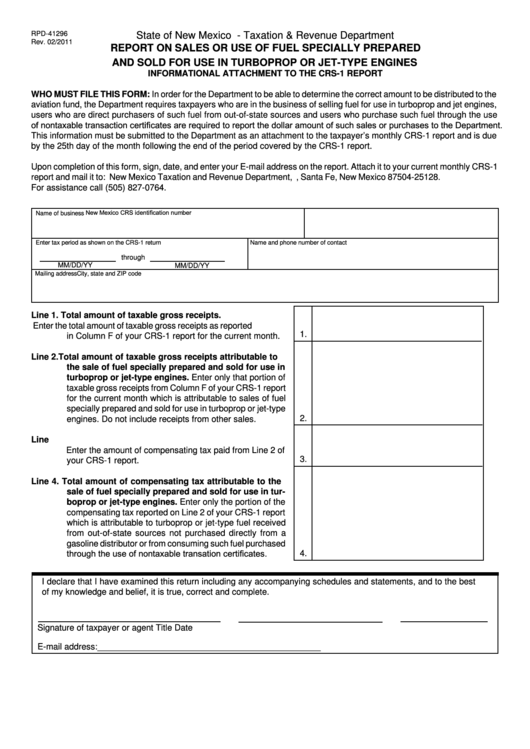

RPD-41296

State of New Mexico - Taxation & Revenue Department

Rev. 02/2011

REPORT ON SALES OR USE OF FUEL SPECIALLY PREPARED

AND SOLD FOR USE IN TURBOPROP OR JET-TYPE ENGINES

INFORMATIONAL ATTACHMENT TO THE CRS-1 REPORT

WHO MUST FILE THIS FORM: In order for the Department to be able to determine the correct amount to be distributed to the

aviation fund, the Department requires taxpayers who are in the business of selling fuel for use in turboprop and jet engines,

users who are direct purchasers of such fuel from out-of-state sources and users who purchase such fuel through the use

of nontaxable transaction certificates are required to report the dollar amount of such sales or purchases to the Department.

This information must be submitted to the Department as an attachment to the taxpayer’s monthly CRS-1 report and is due

by the 25th day of the month following the end of the period covered by the CRS-1 report.

Upon completion of this form, sign, date, and enter your E-mail address on the report. Attach it to your current monthly CRS-1

report and mail it to: New Mexico Taxation and Revenue Department, P.O. Box 25128, Santa Fe, New Mexico 87504-25128.

For assistance call (505) 827-0764.

New Mexico CRS identification number

Name of business

Enter tax period as shown on the CRS-1 return

Name and phone number of contact

through

MM/DD/YY

MM/DD/YY

Mailing address

City, state and ZIP code

Line 1. Total amount of taxable gross receipts.

Enter the total amount of taxable gross receipts as reported

1.

in Column F of your CRS-1 report for the current month.

Line 2. Total amount of taxable gross receipts attributable to

the sale of fuel specially prepared and sold for use in

turboprop or jet-type engines. Enter only that portion of

taxable gross receipts from Column F of your CRS-1 report

for the current month which is attributable to sales of fuel

specially prepared and sold for use in turboprop or jet-type

2.

engines. Do not include receipts from other sales.

Line 3. Total amount of compensating tax.

Enter the amount of compensating tax paid from Line 2 of

3.

your CRS-1 report.

Line 4. Total amount of compensating tax attributable to the

sale of fuel specially prepared and sold for use in tur-

boprop or jet-type engines. Enter only the portion of the

compensating tax reported on Line 2 of your CRS-1 report

which is attributable to turboprop or jet-type fuel received

from out-of-state sources not purchased directly from a

gasoline distributor or from consuming such fuel purchased

through the use of nontaxable transation certificates.

4.

I declare that I have examined this return including any accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct and complete.

Signature of taxpayer or agent

Title

Date

E-mail address:_______________________________________________

1

1