Reset Form

CIG 23

Rev. 8/13

P.O. Box 530

Columbus, OH

43216-0530

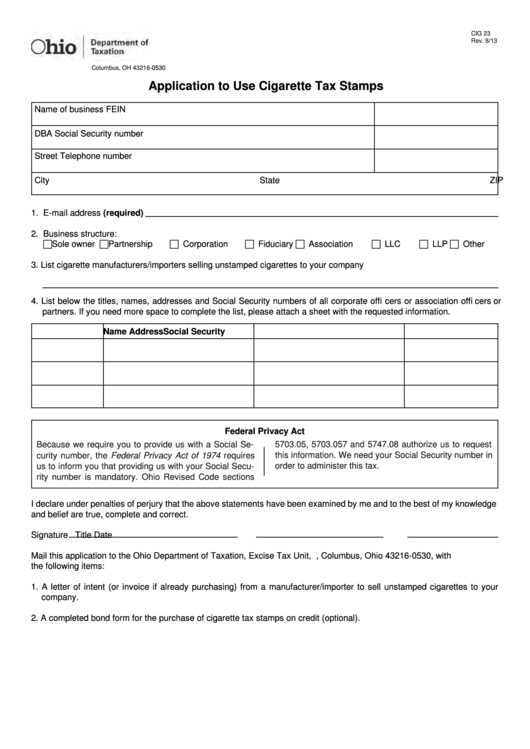

Application to Use Cigarette Tax Stamps

Name of business

FEIN

DBA

Social Security number

Street

Telephone number

City

State

ZIP code

1. E-mail address (required)

2. Business structure:

Sole owner

Partnership

Corporation

Fiduciary

Association

LLC

LLP

Other

3. List cigarette manufacturers/importers selling unstamped cigarettes to your company

4. List below the titles, names, addresses and Social Security numbers of all corporate offi cers or association offi cers or

partners. If you need more space to complete the list, please attach a sheet with the requested information.

Title

Name

Address

Social Security No.

Federal Privacy Act

5703.05, 5703.057 and 5747.08 authorize us to request

Because we require you to provide us with a Social Se-

curity number, the Federal Privacy Act of 1974 requires

this information. We need your Social Security number in

us to inform you that providing us with your Social Secu-

order to administer this tax.

rity number is mandatory. Ohio Revised Code sections

I declare under penalties of perjury that the above statements have been examined by me and to the best of my knowledge

and belief are true, complete and correct.

Signature

Title

Date

Mail this application to the Ohio Department of Taxation, Excise Tax Unit, P.O. Box 530, Columbus, Ohio 43216-0530, with

the following items:

1. A letter of intent (or invoice if already purchasing) from a manufacturer/importer to sell unstamped cigarettes to your

company.

2. A completed bond form for the purchase of cigarette tax stamps on credit (optional).

1

1