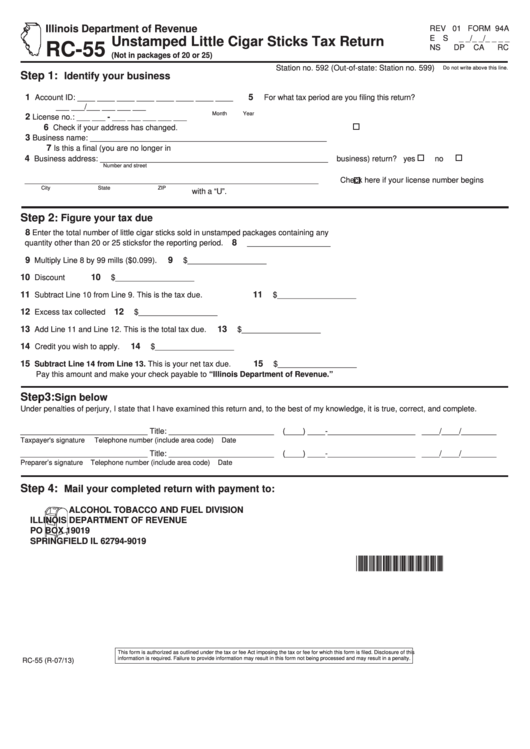

Illinois Department of Revenue

REV 01 FORM 94A

E S

_ _/_ _/_ _ _ _

Unstamped Little Cigar Sticks Tax Return

RC-55

NS

DP

CA

RC

(Not in packages of 20 or 25)

Station no. 592 (Out-of-state: Station no. 599)

Do not write above this line.

Step 1:

Identify your business

1

5

Account ID: ____ ____ ____ ____ ____ ____ ____ ____

For what tax period are you filing this return?

___ ___/___ ___ ___ ___

Month

Year

2

License no.: ___ ___ - ___ ___ ___ ___ ___

6

Check if your address has changed.

3

Business name: ______________________________________________________

7

Is this a final (you are no longer in

4

Business address: ____________________________________________________

business) return?

yes

no

Number and street

___________________________________________________________________

Check here if your license number begins

City

State

ZIP

with a “U”.

Step 2

: Figure your tax due

8

Enter the total number of little cigar sticks sold in unstamped packages containing any

8

quantity other than 20 or 25 sticks for the reporting period.

___________________

9

9

Multiply Line 8 by 99 mills ($0.099).

$__________________

10

10

Discount

$__________________

11

11

Subtract Line 10 from Line 9. This is the tax due.

$__________________

12

12

Excess tax collected

$__________________

13

13

Add Line 11 and Line 12. This is the total tax due.

$__________________

14

14

Credit you wish to apply.

$__________________

15

15

Subtract Line 14 from Line 13. This is your net tax due.

$__________________

Pay this amount and make your check payable to “Illinois Department of Revenue.”

Step 3:

Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________ Title: ________________________

(____) ____-____________________

____/____/________

Taxpayer's signature

Telephone number (include area code)

Date

_____________________________ Title: ________________________

(____) ____-____________________

____/____/________

Preparer’s signature

Telephone number (include area code)

Date

Step 4:

Mail your completed return with payment to:

ALCOHOL TOBACCO AND FUEL DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

*394A11110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

RC-55 (R-07/13)

1

1