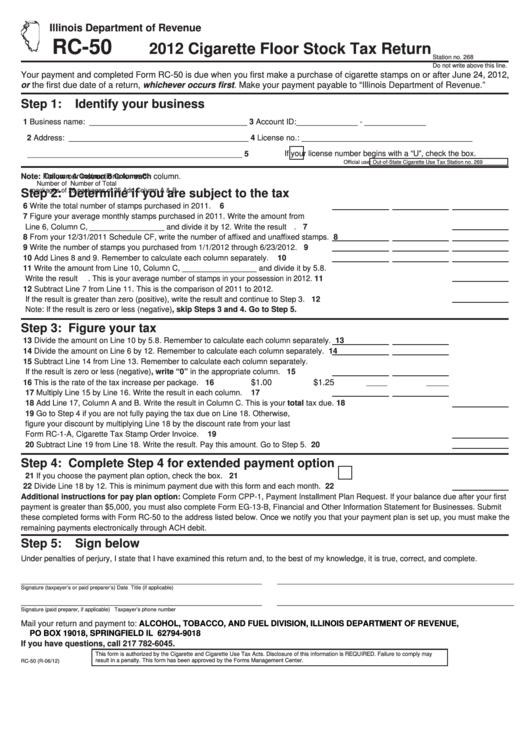

Illinois Department of Revenue

RC-50

2012 Cigarette Floor Stock Tax Return

Station no. 268

Do not write above this line.

Your payment and completed Form RC-50 is due when you first make a purchase of cigarette stamps on or after June 24, 2012,

or the first due date of a return, whichever occurs first. Make your payment payable to “Illinois Department of Revenue.”

Step 1:

Identify your business

1

Business name: ____________________________________

3

Account ID:______________ - ______________

2

Address: _________________________________________

4

License no.: _______________________________________

If your license number begins with a “U”, check the box.

_________________________________________________

5

Official use: Out-of-State Cigarette Use Tax Station no. 269

Note: Follow our instructions for each column.

Column A

Column B

Column C

Number of

Number of

Total

packages of 20

packages of 25

Add Column A & B

Step 2: Determine if you are subject to the tax

6 Write the total number of stamps purchased in 2011.

6

7 Figure your average monthly stamps purchased in 2011. Write the amount from

Line 6, Column C, _________________ and divide it by 12. Write the result.

7

8 From your 12/31/2011 Schedule CF, write the number of affixed and unaffixed stamps.

8

9 Write the number of stamps you purchased from 1/1/2012 through 6/23/2012.

9

10 Add Lines 8 and 9. Remember to calculate each column separately.

10

11 Write the amount from Line 10, Column C, _________________ and divide it by 5.8.

Write the result. This is your average number of stamps in your possession in 2012.

11

12 Subtract Line 7 from Line 11. This is the comparison of 2011 to 2012.

If the result is greater than zero (positive), write the result and continue to Step 3.

12

Note: If the result is zero or less (negative), skip Steps 3 and 4. Go to Step 5.

Step 3: Figure your tax

13 Divide the amount on Line 10 by 5.8. Remember to calculate each column separately. 13

14 Divide the amount on Line 6 by 12. Remember to calculate each column separately. 14

15 Subtract Line 14 from Line 13. Remember to calculate each column separately.

If the result is zero or less (negative), write “0” in the appropriate column.

15

$1.00

$1.25

16 This is the rate of the tax increase per package.

16

17 Multiply Line 15 by Line 16. Write the result in each column.

17

18 Add Line 17, Column A and B. Write the result in Column C. This is your total tax due. 18

19 Go to Step 4 if you are not fully paying the tax due on Line 18. Otherwise,

figure your discount by multiplying Line 18 by the discount rate from your last

Form RC-1-A, Cigarette Tax Stamp Order Invoice.

19

20 Subtract Line 19 from Line 18. Write the result. Pay this amount. Go to Step 5.

20

Step 4: Complete Step 4 for extended payment option

21 If you choose the payment plan option, check the box.

21

22 Divide Line 18 by 12. This is minimum payment due with this form and each month. 22

Additional instructions for pay plan option: Complete Form CPP-1, Payment Installment Plan Request. If your balance due after your first

payment is greater than $5,000, you must also complete Form EG-13-B, Financial and Other Information Statement for Businesses. Submit

these completed forms with Form RC-50 to the address listed below. Once we notify you that your payment plan is set up, you must make the

remaining payments electronically through ACH debit.

Step 5:

Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Signature (taxpayer’s or paid preparer’s)

Date

Title (if applicable)

_______________________________________________________

______________________________________________________

Signature (paid preparer, if applicable)

Taxpayer’s phone number

Mail your return and payment to:

ALCOHOL, TOBACCO, AND FUEL DIVISION, ILLINOIS DEPARTMENT OF REVENUE,

PO BOX 19018, SPRINGFIELD IL 62794-9018

If you have questions, call 217 782-6045.

This form is authorized by the Cigarette and Cigarette Use Tax Acts. Disclosure of this information is REQUIRED. Failure to comply may

result in a penalty. This form has been approved by the Forms Management Center.

RC-50 (R-06/12)

1

1