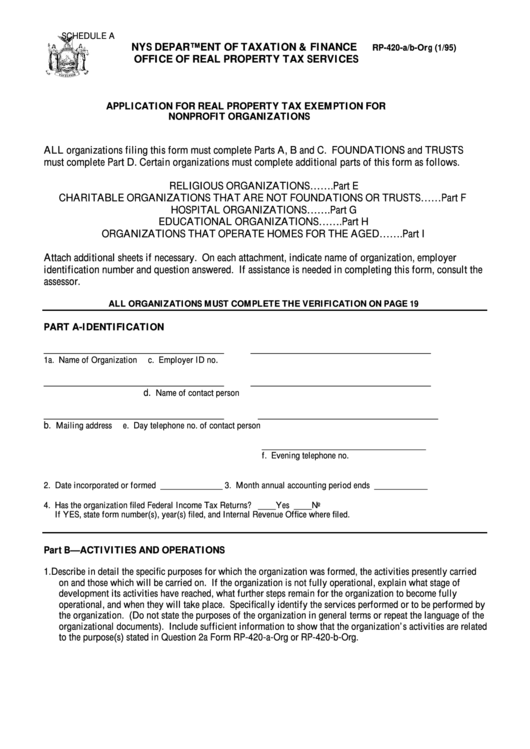

SCHEDULE A

NYS DEPARTMENT OF TAXATION & FINANCE

RP-420-a/b-Org (1/95)

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR

NONPROFIT ORGANIZATIONS

ALL organizations filing this form must complete Parts A, B and C. FOUNDATIONS and TRUSTS

must complete Part D. Certain organizations must complete additional parts of this form as follows.

RELIGIOUS ORGANIZATIONS…….Part E

CHARITABLE ORGANIZATIONS THAT ARE NOT FOUNDATIONS OR TRUSTS……Part F

HOSPITAL ORGANIZATIONS…….Part G

EDUCATIONAL ORGANIZATIONS…….Part H

ORGANIZATIONS THAT OPERATE HOMES FOR THE AGED…….Part I

Attach additional sheets if necessary. On each attachment, indicate name of organization, employer

identification number and question answered. If assistance is needed in completing this form, consult the

assessor.

ALL ORGANIZATIONS MUST COMPLETE THE VERIFICATION ON PAGE 19

PART A-IDENTIFICATION

_____________________________________

_____________________________________

.

1a. Name of Organization

c. Employer ID no

_____________________________________

_____________________________________

d.

Name of contact person

_____________________________________

_____________________________________

b.

Mailing address

e. Day telephone no. of contact person

_____________________________________

f. Evening telephone no.

2. Date incorporated or formed ______________

3. Month annual accounting period ends ____________

4. Has the organization filed Federal Income Tax Returns? ____Yes ____No

If YES, state form number(s), year(s) filed, and Internal Revenue Office where filed.

Part B—ACTIVITIES AND OPERATIONS

1. Describe in detail the specific purposes for which the organization was formed, the activities presently carried

on and those which will be carried on. If the organization is not fully operational, explain what stage of

development its activities have reached, what further steps remain for the organization to become fully

operational, and when they will take place. Specifically identify the services performed or to be performed by

the organization. (Do not state the purposes of the organization in general terms or repeat the language of the

organizational documents). Include sufficient information to show that the organization’s activities are related

to the purpose(s) stated in Question 2a Form RP-420-a-Org or RP-420-b-Org.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18