Tax Declaration For Other Tobacco Products

ADVERTISEMENT

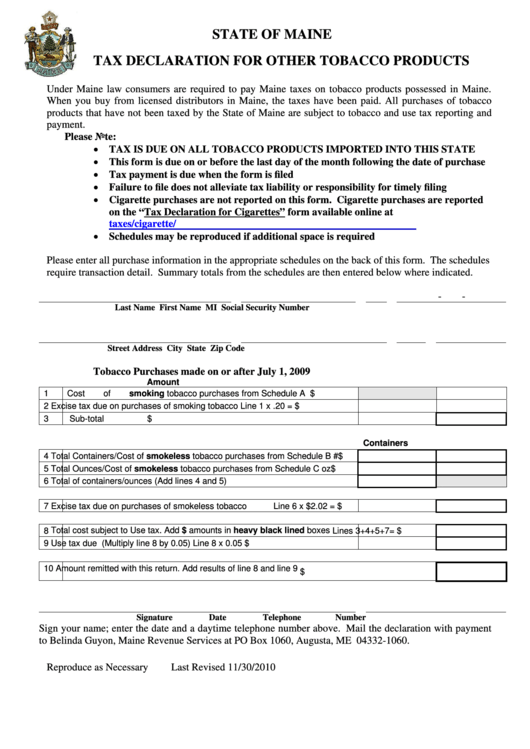

STATE OF MAINE

TAX DECLARATION FOR OTHER TOBACCO PRODUCTS

Under Maine law consumers are required to pay Maine taxes on tobacco products possessed in Maine.

When you buy from licensed distributors in Maine, the taxes have been paid. All purchases of tobacco

products that have not been taxed by the State of Maine are subject to tobacco and use tax reporting and

payment.

Please Note:

• TAX IS DUE ON ALL TOBACCO PRODUCTS IMPORTED INTO THIS STATE

• This form is due on or before the last day of the month following the date of purchase

• Tax payment is due when the form is filed

• Failure to file does not alleviate tax liability or responsibility for timely filing

• Cigarette purchases are not reported on this form. Cigarette purchases are reported

on the “Tax Declaration for Cigarettes” form available online at

• Schedules may be reproduced if additional space is required

Please enter all purchase information in the appropriate schedules on the back of this form. The schedules

require transaction detail. Summary totals from the schedules are then entered below where indicated.

-

-

Last Name

First Name

MI

Social Security Number

Street Address

City

State

Zip Code

Tobacco Purchases made on or after July 1, 2009

Amount

1

Cost of smoking tobacco purchases from Schedule A

$

2

Excise tax due on purchases of smoking tobacco

Line 1 x .20 =

$

3

Sub-total

$

Containers

4

Total Containers/Cost of smokeless tobacco purchases from Schedule B

#

$

5

Total Ounces/Cost of smokeless tobacco purchases from Schedule C

oz

$

6

Total of containers/ounces (Add lines 4 and 5)

7

Excise tax due on purchases of smokeless tobacco

Line 6 x $2.02 =

$

Total cost subject to Use tax. Add $ amounts in heavy black lined boxes

8

Lines 3+4+5+7=

$

9

Use tax due (Multiply line 8 by 0.05)

Line 8 x 0.05

$

10

Amount remitted with this return. Add results of line 8 and line 9

$

Signature

Date

Telephone Number

Sign your name; enter the date and a daytime telephone number above. Mail the declaration with payment

to Belinda Guyon, Maine Revenue Services at PO Box 1060, Augusta, ME 04332-1060.

Reproduce as Necessary

Last Revised 11/30/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2