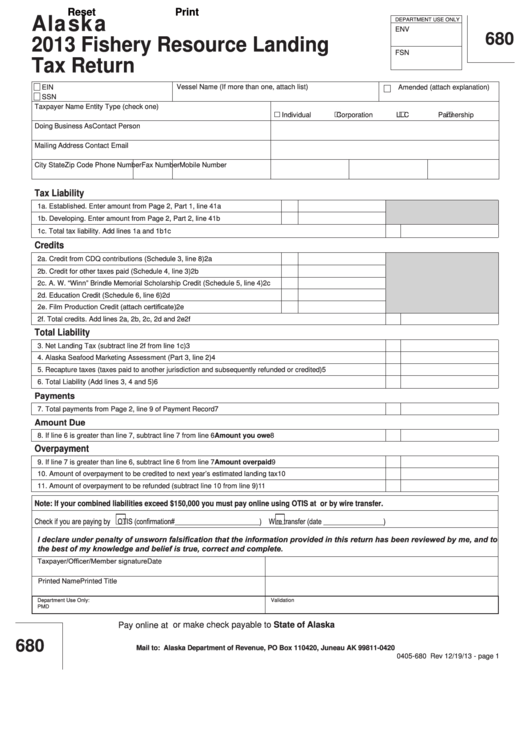

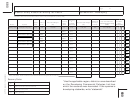

Alaska

Reset

Print

DEPARTMENT USE ONLY

ENV

2013 Fishery Resource Landing

680

FSN

Tax Return

EIN

Vessel Name (If more than one, attach list)

Amended (attach explanation)

SSN

Taxpayer Name

Entity Type (check one)

Individual

Corporation

LLC

Partnership

Doing Business As

Contact Person

Mailing Address

Contact Email

City

State

Zip Code

Phone Number

Fax Number

Mobile Number

Tax Liability

1a. Established. Enter amount from Page 2, Part 1, line 4

1a

1b. Developing. Enter amount from Page 2, Part 2, line 4

1b

1c. Total tax liability. Add lines 1a and 1b

1c

Credits

2a. Credit from CDQ contributions (Schedule 3, line 8)

2a

2b. Credit for other taxes paid (Schedule 4, line 3)

2b

2c. A. W. “Winn” Brindle Memorial Scholarship Credit (Schedule 5, line 4)

2c

2d. Education Credit (Schedule 6, line 6)

2d

2e. Film Production Credit (attach certificate)

2e

2f. Total credits. Add lines 2a, 2b, 2c, 2d and 2e

2f

Total Liability

3. Net Landing Tax (subtract line 2f from line 1c)

3

4. Alaska Seafood Marketing Assessment (Part 3, line 2)

4

5. Recapture taxes (taxes paid to another jurisdiction and subsequently refunded or credited)

5

6. Total Liability (Add lines 3, 4 and 5)

6

Payments

7. Total payments from Page 2, line 9 of Payment Record

7

Amount Due

Amount you owe

8. If line 6 is greater than line 7, subtract line 7 from line 6

8

Overpayment

Amount overpaid

9. If line 7 is greater than line 6, subtract line 6 from line 7

9

10. Amount of overpayment to be credited to next year’s estimated landing tax

10

11. Amount of overpayment to be refunded (subtract line 10 from line 9)

11

Note: If your combined liabilities exceed $150,000 you must pay online using OTIS at or by wire transfer.

Check if you are paying by

OTIS (confirmation#________________________)

Wire transfer (date _________________)

I declare under penalty of unsworn falsification that the information provided in this return has been reviewed by me, and to

the best of my knowledge and belief is true, correct and complete.

Taxpayer/Officer/Member signature

Date

Printed Name

Printed Title

Department Use Only:

Validation

PMD

Pay online at or make check payable to State of Alaska

680

Mail to: Alaska Department of Revenue, PO Box 110420, Juneau AK 99811-0420

0405-680 Rev 12/19/13 - page 1

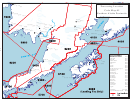

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18