Taxpayer name

680

Federal EIN or SSN

Alaska Fishery Resource Landing Tax Return

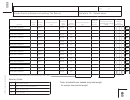

Schedule 3 - CDQ Credit

Credit for Approved Contributions Under a CDQ

Explanation: A taxpayer who harvests a fishery resource un-

Limitation: The credit is limited to 45.45% of the tax due on the

der the provisions of a community development quota (CDQ) may

value of the fishery resource harvested under the CDQ.

claim qualifying contributions as a credit. Contributions must have

been approved by the Tax Division. Use Form 681 - CDQ Credit

Application to apply no later than January 31 of the year following

the tax year.

Department use only

1

Total unprocessed value from Schedules 2E

1

2

Multiply line 1 by 3% (.03)

2

3

Total unprocessed value from Schedules 2D

3

4

Multiply line 3 by 1% (.01)

4

5

Tax on resources harvested under a CDQ (add lines 2 and 4)

5

6

Maximum credit available [multiply line 5 by 45.45% (.4545)]

6

7

Approved contributions (from CDQ Credit Application Form)

7

8

CDQ Credit. Enter lesser of line 6 or line 7 here and on Page 1, line 2a

8

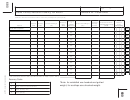

Alaska Fishery Resource Landing Tax Return

Schedule 4 - Credit for Other Taxes Paid

Explanation: Before a credit is allowed for taxes paid to another

Limitation: The amount of the credit for taxes paid to another

jurisdiction, you must attach a statement attesting that the tax has

jurisdiction on the fishery resource may not exceed the landing tax

been paid, indicating the date the payment was made, describing

liability that applies to the same fishery resource. For purposes of

the nature of the tax and providing citation to the statutory or

this section, “jurisdiction” includes a state other than Alaska, the

other legal authority of the jurisdiction that imposed the tax. You

United States or a foreign country.

must also attach a copy of the return or report filed with other

jurisdictions for which credits are being claimed.

Department use only

Enter the Alaska landing tax incurred on fishery resources subjected to tax by

1

1

another jurisdiction

Taxes paid to another jurisdiction

2

2

Credit for other taxes. Enter lesser of line 1 or 2 here and on Page 1, line 2b

3

3

680

0405-680 Rev 12/19/13 - page 13

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18