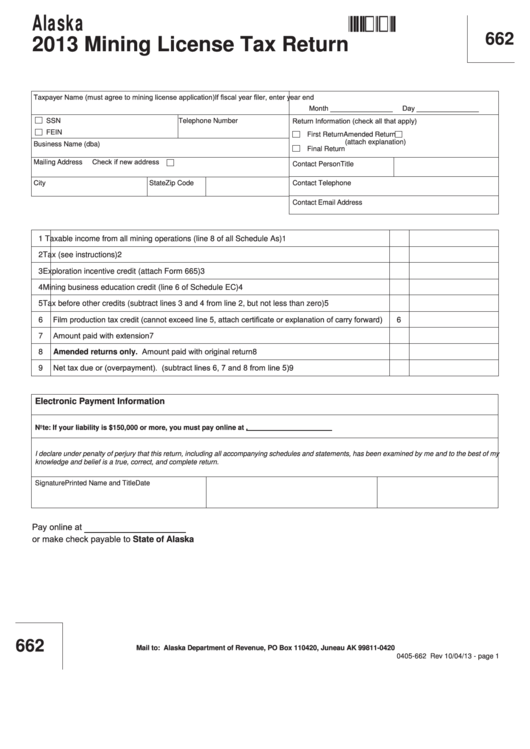

Form 0405-662 - Mining License Tax Return - 2013

ADVERTISEMENT

Alaska

662:10 04 13

2013 Mining License Tax Return

662

Taxpayer Name (must agree to mining license application)

If fiscal year filer, enter year end

Month ________________

Day ________________

Return Information (check all that apply)

SSN

Telephone Number

FEIN

First Return

Amended Return

(attach explanation)

Business Name (dba)

Final Return

Check if new address

Mailing Address

Contact Person

Title

City

State

Zip Code

Contact Telephone

Contact Email Address

1

Taxable income from all mining operations (line 8 of all Schedule As)

1

2

Tax (see instructions)

2

3

Exploration incentive credit (attach Form 665)

3

4

Mining business education credit (line 6 of Schedule EC)

4

5

Tax before other credits (subtract lines 3 and 4 from line 2, but not less than zero)

5

Film production tax credit (cannot exceed line 5, attach certificate or explanation of carry forward)

6

6

Amount paid with extension

7

7

Amended returns only. Amount paid with original return

8

8

Net tax due or (overpayment). (subtract lines 6, 7 and 8 from line 5)

9

9

Electronic Payment Information

Note: If your liability is $150,000 or more, you must pay online at

I declare under penalty of perjury that this return, including all accompanying schedules and statements, has been examined by me and to the best of my

knowledge and belief is a true, correct, and complete return.

Signature

Printed Name and Title

Date

Pay online at

or make check payable to State of Alaska

662

Mail to: Alaska Department of Revenue, PO Box 110420, Juneau AK 99811-0420

0405-662 Rev 10/04/13 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7