Petition For Refund Filing Instructions - Alabama Department Of Revenue

ADVERTISEMENT

SUBT: RI

A

D

R

LABAMA

EPARTMENT OF

EVENUE

10/11

B

L

T

D

USINESS AND

ICENSE

AX

IVISION

Petition For Refund Filing Instructions

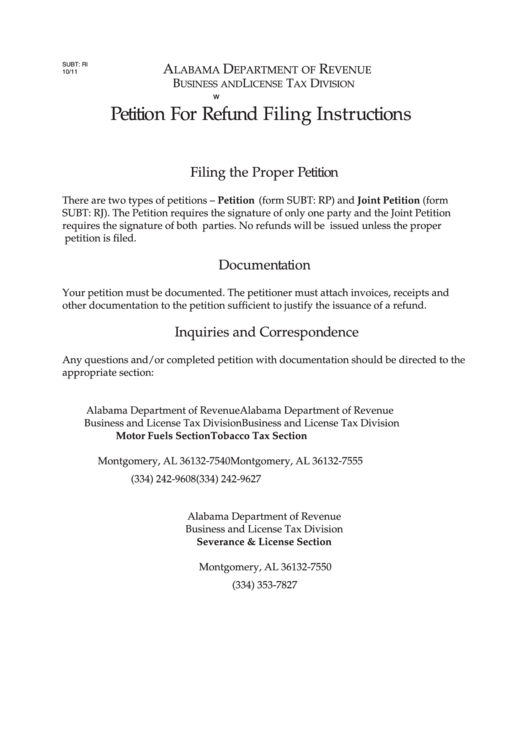

Filing the Proper Petition

There are two types of petitions – Petition (form SUBT: RP) and Joint Petition (form

SUBT: RJ). The Petition requires the signature of only one party and the Joint Petition

requires the signature of both parties. No refunds will be issued unless the proper

petition is filed.

Documentation

Your petition must be documented. The petitioner must attach invoices, receipts and

other documentation to the petition sufficient to justify the issuance of a refund.

Inquiries and Correspondence

Any questions and/or completed petition with documentation should be directed to the

appropriate section:

Alabama Department of Revenue

Alabama Department of Revenue

Business and License Tax Division

Business and License Tax Division

Motor Fuels Section

Tobacco Tax Section

P.O. Box 327540

P.O. Box 327555

Montgomery, AL 36132-7540

Montgomery, AL 36132-7555

(334) 242-9608

(334) 242-9627

Alabama Department of Revenue

Business and License Tax Division

Severance & License Section

P.O. Box 327550

Montgomery, AL 36132-7550

(334) 353-7827

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1