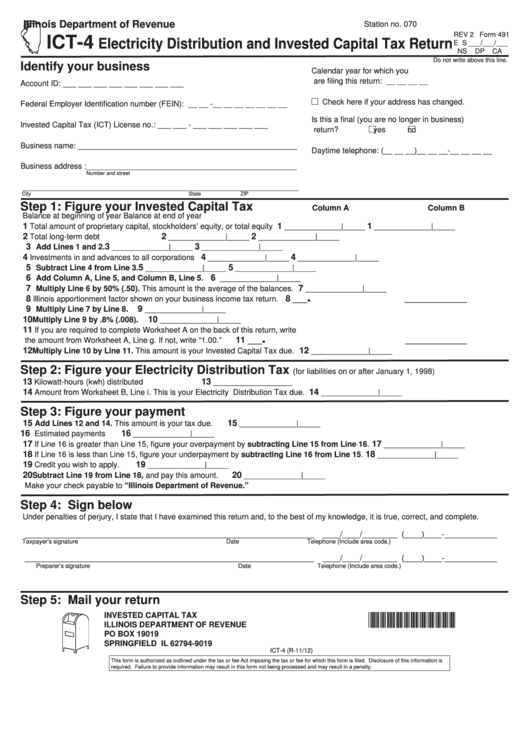

Illinois Department of Revenue

Station no. 070

REV 2 Form 491

ICT-4

Electricity Distribution and Invested Capital Tax Return

E S ___/___/___

NS

DP

CA

Do not write above this line.

Identify your business

Calendar year for which you

are filing this return: __ __ __ __

Account ID: ___ ___ ___ ___ ___ ___ ___ ___

Check here if your address has changed.

Federal Employer Identification number (FEIN):

__ __ -__ __ __ __ __ __ __

Is this a final (you are no longer in business)

Invested Capital Tax (ICT) License no.: ___ ___ - ___ ___ ___ ___ ___

return?

yes

no

Business name: __________________________________________________

Daytime telephone: (__ __ __)__ __ __-__ __ __ __

Business address :________________________________________________

Number and street

_______________________________________________________________

City

State

ZIP

Step 1: Figure your Invested Capital Tax

Column A

Column B

Balance at beginning of year

Balance at end of year

1

1

1

Total amount of proprietary capital, stockholders’ equity, or total equity

_____________|_____

_____________|_____

2

2

2

Total long-term debt

_____________|_____

_____________|_____

3

3

3

Add Lines 1 and 2.

_____________|_____

_____________|_____

4

4

4

Investments in and advances to all corporations

_____________|_____

_____________|_____

5

5

5

Subtract Line 4 from Line 3.

_____________|_____

_____________|_____

6

6

Add Column A, Line 5, and Column B, Line 5.

_____________|_____

7

7

Multiply Line 6 by 50% (.50). This amount is the average of the balances.

_____________|_____

.

8

8 ___

Illinois apportionment factor shown on your business income tax return.

______________

9

9

Multiply Line 7 by Line 8.

_____________|_____

10

10

Multiply Line 9 by .8% (.008).

_____________|_____

11

If you are required to complete Worksheet A on the back of this return, write

.

11 ___

the amount from Worksheet A, Line g. If not, write “1.00.”

______________

12

12

Multiply Line 10 by Line 11. This amount is your Invested Capital Tax due.

_____________|_____

Step 2: Figure your Electricity Distribution Tax

(for liabilities on or after January 1, 1998)

13

13

Kilowatt-hours (kwh) distributed

__________________

14

14

Amount from Worksheet B, Line i. This is your Electricity Distribution Tax due.

_____________|_____

Step 3: Figure your payment

15

15

Add Lines 12 and 14. This amount is your tax due.

_____________|_____

16

16

Estimated payments

_____________|_____

17

17

If Line 16 is greater than Line 15, figure your overpayment by subtracting Line 15 from Line 16.

_____________|_____

18

18

If Line 16 is less than Line 15, figure your underpayment by subtracting Line 16 from Line 15.

_____________|_____

19

19

Credit you wish to apply.

_____________|_____

20

20

Subtract Line 19 from Line 18, and pay this amount.

_____________|_____

Make your check payable to “Illinois Department of Revenue.”

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

__________________________________________________________________

____/____/________ (____)____-____________

Taxpayer’s signature

Date

Telephone (Include area code.)

__________________________________________________________________

____/____/________ (____)____-____________

Preparer’s signature

Date

Telephone (Include area code.)

Step 5: Mail your return

*249101110*

INVESTED CAPITAL TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

ICT-4 (R-11/12)

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is

required. Failure to provide information may result in this form not being processed and may result in a penalty.

1

1 2

2