Michigan Department of Treasury

Reset Form

3739 (Rev. 7-09)

Eligible Purchaser Application to Defer Payment to Licensed Supplier

P.A. 403 of 2000, as amended, allows an eligible purchaser to defer payment of the tax on motor fuel to licensed suppliers

until one business day before the motor fuel tax becomes due and payable to the state by the supplier. The supplier is

required to remit the tax on the 20th day of the month following the end of a reporting period. An eligible purchaser must

meet the following requirements to qualify for the election to defer payment:

1. An application to defer payment must be completed by the eligible purchaser and the supplier and forwarded to the

Michigan Department of Treasury for approval. The eligible purchaser must submit a separate application for each

supplier to whom they will be deferring payment of the tax.

2. Eligible purchasers must submit a financial statement with the application to defer payment. An applicant who does not

satisfy the Michigan Department of Treasury as to their financial responsibility will be required to secure a surety bond

or a cash deposit before a deferred plan will be approved. The maximum bond required cannot exceed three times the

estimated monthly tax liability.

3. The eligible purchaser’s payment of all taxes due to the supplier(s) shall be paid by electronic funds transfer on or before

one (1) business day prior to the due date of the tax return.

An Eligible Purchaser Application to Defer Payment must be reviewed and authorized by the Michigan Department

of Treasury. Upon official authorization, the deferred plan will take effect on the first day of the month following the

application approval.

At the election of the eligible purchaser, the licensed supplier must enter into a deferred payment plan; however, a

supplier may terminate this deferment plan if the eligible purchaser does not make timely payments to the supplier

as required by P.A. 403 of 2000, as amended. An eligible purchaser whose deferment plan is terminated by a

supplier and who has deferment plans with other suppliers will be immediately placed on a tax-paid basis with all

suppliers.

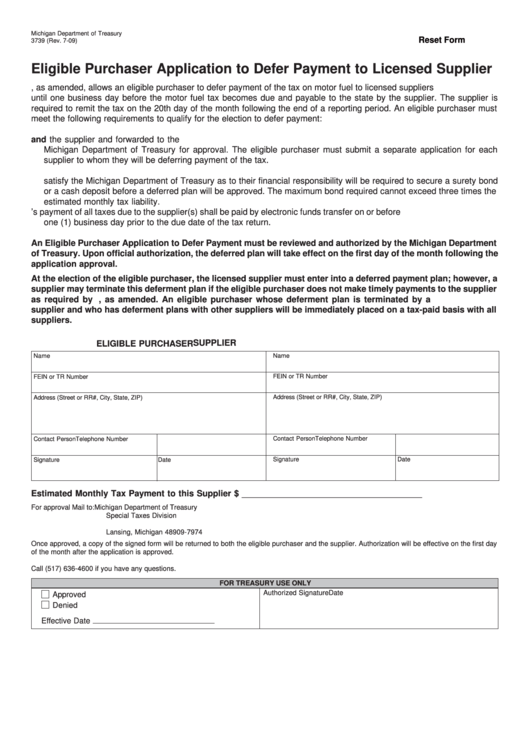

SUPPLIER

ELIGIBLE PURCHASER

Name

Name

FEIN or TR Number

FEIN or TR Number

Address (Street or RR#, City, State, ZIP)

Address (Street or RR#, City, State, ZIP)

Contact Person

Telephone Number

Contact Person

Telephone Number

Signature

Date

Signature

Date

Estimated Monthly Tax Payment to this Supplier $ ______________________________________

For approval Mail to:

Michigan Department of Treasury

Special Taxes Division

P.O. Box 30474

Lansing, Michigan 48909-7974

Once approved, a copy of the signed form will be returned to both the eligible purchaser and the supplier. Authorization will be effective on the first day

of the month after the application is approved.

Call (517) 636-4600 if you have any questions.

FOR TREASURY USE ONLY

Authorized Signature

Date

Approved

Denied

Effective Date

1

1