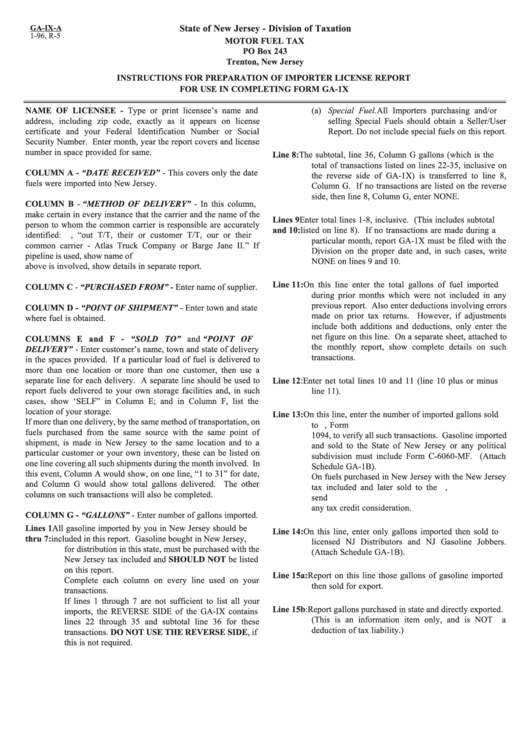

Form Ga-1x - Instructions For Preparation Of Importer License Report

ADVERTISEMENT

GA-IX-A

State of New Jersey - Division of Taxation

1-96, R-5

MOTOR FUEL TAX

PO Box 243

Trenton, New Jersey

INSTRUCTIONS FOR PREPARATION OF IMPORTER LICENSE REPORT

FOR USE IN COMPLETING FORM GA-1X

NAME OF LICENSEE - Type or print licensee’s name and

(a) Special Fuel.

All Importers purchasing and/or

address, including zip code, exactly as it appears on license

selling Special Fuels should obtain a Seller/User

certificate and your Federal Identification Number or Social

Report. Do not include special fuels on this report.

Security Number. Enter month, year the report covers and license

number in space provided for same.

Line 8:

The subtotal, line 36, Column G gallons (which is the

total of transactions listed on lines 22-35, inclusive on

COLUMN A - “DATE RECEIVED” - This covers only the date

the reverse side of GA-1X) is transferred to line 8,

fuels were imported into New Jersey.

Column G. If no transactions are listed on the reverse

side, then line 8, Column G, enter NONE.

COLUMN B - “METHOD OF DELIVERY” - In this column,

make certain in every instance that the carrier and the name of the

Enter total lines 1-8, inclusive. (This includes subtotal

Lines 9

person to whom the common carrier is responsible are accurately

and 10:

listed on line 8). If no transactions are made during a

identified: e.g., “out T/T, their or customer T/T, our or their

particular month, report GA-1X must be filed with the

common carrier - Atlas Truck Company or Barge Jane II.” If

Division on the proper date and, in such cases, write

pipeline is used, show name of P.L. If other carrier than mentioned

NONE on lines 9 and 10.

above is involved, show details in separate report.

Line 11: On this line enter the total gallons of fuel imported

COLUMN C - “PURCHASED FROM” - Enter name of supplier.

during prior months which were not included in any

previous report. Also enter deductions involving errors

COLUMN D - “POINT OF SHIPMENT” - Enter town and state

made on prior tax returns. However, if adjustments

where fuel is obtained.

include both additions and deductions, only enter the

net figure on this line. On a separate sheet, attached to

COLUMNS E and F - “SOLD TO” and “POINT OF

the monthly report, show complete details on such

DELIVERY” - Enter customer’s name, town and state of delivery

transactions.

in the spaces provided. If a particular load of fuel is delivered to

more than one location or more than one customer, then use a

separate line for each delivery. A separate line should be used to

Line 12: Enter net total lines 10 and 11 (line 10 plus or minus

report fuels delivered to your own storage facilities and, in such

line 11).

cases, show ‘SELF” in Column E; and in Column F, list the

location of your storage.

Line 13: On this line, enter the number of imported gallons sold

If more than one delivery, by the same method of transportation, on

to U.S. Government and attach U.S. Certificate, Form

fuels purchased from the same source with the same point of

1094, to verify all such transactions. Gasoline imported

shipment, is made in New Jersey to the same location and to a

and sold to the State of New Jersey or any political

particular customer or your own inventory, these can be listed on

subdivision must include Form C-6060-MF. (Attach

one line covering all such shipments during the month involved. In

Schedule GA-1B).

this event, Column A would show, on one line, “1 to 31” for date,

On fuels purchased in New Jersey with the New Jersey

and Column G would show total gallons delivered. The other

tax included and later sold to the U.S. Government,

columns on such transactions will also be completed.

send U.S. Form 1094 to your New Jersey supplier for

any tax credit consideration.

COLUMN G - “GALLONS” - Enter number of gallons imported.

Lines 1

All gasoline imported by you in New Jersey should be

Line 14: On this line, enter only gallons imported then sold to

thru 7:

included in this report. Gasoline bought in New Jersey,

licensed NJ Distributors and NJ Gasoline Jobbers.

for distribution in this state, must be purchased with the

(Attach Schedule GA-1B).

New Jersey tax included and SHOULD NOT be listed

on this report.

Line 15a: Report on this line those gallons of gasoline imported

Complete each column on every line used on your

then sold for export.

transactions.

If lines 1 through 7 are not sufficient to list all your

Line 15b: Report gallons purchased in state and directly exported.

imports, the REVERSE SIDE of the GA-IX contains

(This is an information item only, and is NOT

a

lines 22 through 35 and subtotal line 36 for these

deduction of tax liability.)

transactions. DO NOT USE THE REVERSE SIDE, if

this is not required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2