Schedules Ga-1-D And Ga-1-J - Specific Instructions For Filing The New Jersey Motor Fuel Distributors / Jobbers Monthly Report And Schedules

ADVERTISEMENT

STATE OF NEW JERSEY

General Instructions

General Information

GA-1-D and GA-1-J

609-984-7171

Division of Taxation

(4-98)

Motor Fuel Tax

GENERAL INFORMATION

(GA-1-D and GA-1-J)

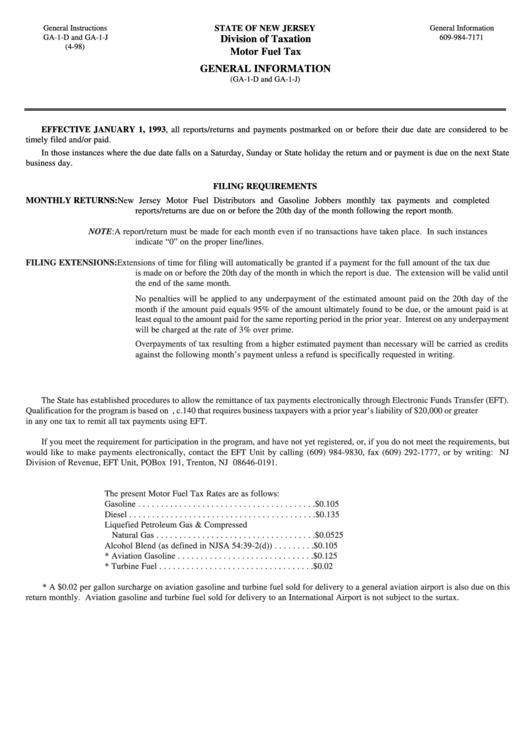

EFFECTIVE JANUARY 1, 1993, all reports/returns and payments postmarked on or before their due date are considered to be

timely filed and/or paid.

In those instances where the due date falls on a Saturday, Sunday or State holiday the return and or payment is due on the next State

business day.

FILING REQUIREMENTS

MONTHLY RETURNS:

New Jersey Motor Fuel Distributors and Gasoline Jobbers monthly tax payments and completed

reports/returns are due on or before the 20th day of the month following the report month.

NOTE:

A report/return must be made for each month even if no transactions have taken place. In such instances

indicate “0” on the proper line/lines.

FILING EXTENSIONS:

Extensions of time for filing will automatically be granted if a payment for the full amount of the tax due

is made on or before the 20th day of the month in which the report is due. The extension will be valid until

the end of the same month.

No penalties will be applied to any underpayment of the estimated amount paid on the 20th day of the

month if the amount paid equals 95% of the amount ultimately found to be due, or the amount paid is at

least equal to the amount paid for the same reporting period in the prior year. Interest on any underpayment

will be charged at the rate of 3% over prime.

Overpayments of tax resulting from a higher estimated payment than necessary will be carried as credits

against the following month’s payment unless a refund is specifically requested in writing.

The State has established procedures to allow the remittance of tax payments electronically through Electronic Funds Transfer (EFT).

Qualification for the program is based on P.L. 1992, c.140 that requires business taxpayers with a prior year’s liability of $20,000 or greater

in any one tax to remit all tax payments using EFT.

If you meet the requirement for participation in the program, and have not yet registered, or, if you do not meet the requirements, but

would like to make payments electronically, contact the EFT Unit by calling (609) 984-9830, fax (609) 292-1777, or by writing: NJ

Division of Revenue, EFT Unit, PO Box 191, Trenton, NJ 08646-0191.

The present Motor Fuel Tax Rates are as follows:

Gasoline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.105

Diesel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.135

Liquefied Petroleum Gas & Compressed

Natural Gas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.0525

Alcohol Blend (as defined in NJSA 54:39-2(d)) . . . . . . . . . $0.105

* Aviation Gasoline . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.125

* Turbine Fuel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.02

* A $0.02 per gallon surcharge on aviation gasoline and turbine fuel sold for delivery to a general aviation airport is also due on this

return monthly. Aviation gasoline and turbine fuel sold for delivery to an International Airport is not subject to the surtax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4