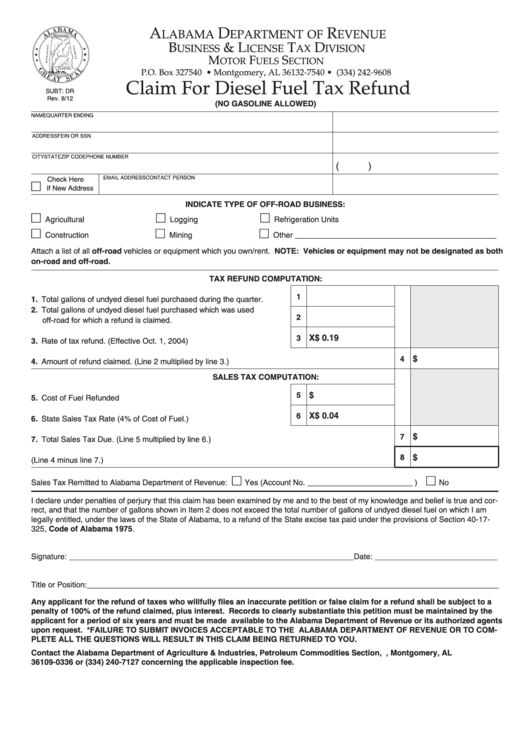

A

D

R

LABAMA

EPARTMENT OF

EVENUE

B

& L

T

D

USINESS

ICENSE

AX

IVISION

RESET

M

F

S

OTOR

UELS

ECTION

P.O. Box 327540 • Montgomery, AL 36132-7540 • (334) 242-9608

Claim For Diesel Fuel Tax Refund

SUBT: DR

Rev. 8/12

(NO GASOLINE ALLOWED)

NAME

QUARTER ENDING

ADDRESS

FEIN OR SSN

CITY

STATE

ZIP CODE

PHONE NUMBER

(

)

EMAIL ADDRESS

CONTACT PERSON

Check Here

If New Address

INDICATE TYPE OF OFF-ROAD BUSINESS:

Agricultural

Logging

Refrigeration Units

Construction

Mining

Other ______________________________________________

Attach a list of all off-road vehicles or equipment which you own/rent. NOTE: Vehicles or equipment may not be designated as both

on-road and off-road.

TAX REFUND COMPUTATION:

1

1. Total gallons of undyed diesel fuel purchased during the quarter. . . . . . .

2. Total gallons of undyed diesel fuel purchased which was used

2

off-road for which a refund is claimed.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X

$ 0.19

3

3. Rate of tax refund. (Effective Oct. 1, 2004). . . . . . . . . . . . . . . . . . . . . . . . . .

$

4

4. Amount of refund claimed. (Line 2 multiplied by line 3.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SALES TAX COMPUTATION:

$

5

5. Cost of Fuel Refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X

$ 0.04

6

6. State Sales Tax Rate (4% of Cost of Fuel.) . . . . . . . . . . . . . . . . . . . . . . . . .

$

7

7. Total Sales Tax Due. (Line 5 multiplied by line 6.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8

8. Net Refund Due (Line 4 minus line 7.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Sales Tax Remitted to Alabama Department of Revenue:

Yes (Account No. ________________________ )

No

I declare under penalties of perjury that this claim has been examined by me and to the best of my knowledge and belief is true and cor-

rect, and that the number of gallons shown in Item 2 does not exceed the total number of gallons of undyed diesel fuel on which I am

legally entitled, under the laws of the State of Alabama, to a refund of the State excise tax paid under the provisions of Section 40-17-

325, Code of Alabama 1975.

Signature: _________________________________________________________________ Date: ____________________________

Title or Position: ______________________________________________________________________________________________

Any applicant for the refund of taxes who willfully files an inaccurate petition or false claim for a refund shall be subject to a

penalty of 100% of the refund claimed, plus interest. Records to clearly substantiate this petition must be maintained by the

applicant for a period of six years and must be made available to the Alabama Department of Revenue or its authorized agents

upon request. *FAILURE TO SUBMIT INVOICES ACCEPTABLE TO THE ALABAMA DEPARTMENT OF REVENUE OR TO COM-

PLETE ALL THE QUESTIONS WILL RESULT IN THIS CLAIM BEING RETURNED TO YOU.

Contact the Alabama Department of Agriculture & Industries, Petroleum Commodities Section, P.O. Box 3336, Montgomery, AL

36109-0336 or (334) 240-7127 concerning the applicable inspection fee.

1

1 2

2