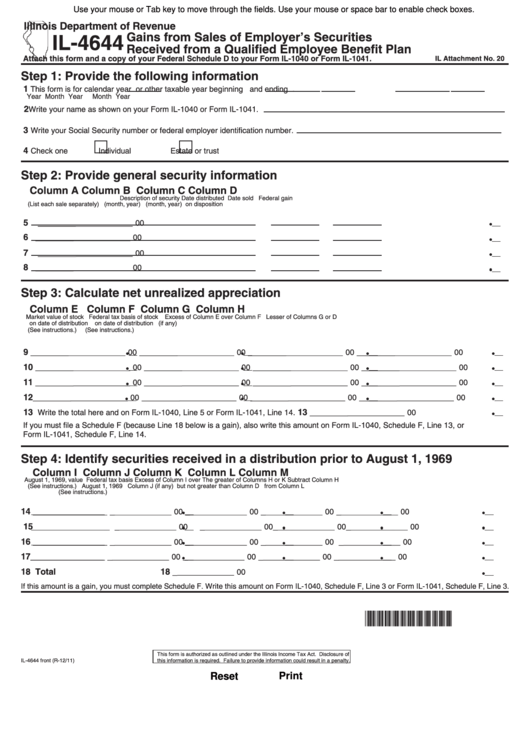

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Gains from Sales of Employer’s Securities

IL-4644

Received from a Qualified Employee Benefit Plan

Attach this form and a copy of your Federal Schedule D to your Form IL-1040 or Form IL-1041.

IL Attachment No. 20

Step 1: Provide the following information

1

This form is for calendar year

or other taxable year beginning

and ending

.

Year

Month

Year

Month

Year

2

Write your name as shown on your Form IL-1040 or Form IL-1041.

3

Write your Social Security number or federal employer identification number.

4

Check one

Individual

Estate or trust

Step 2: Provide general security information

Column A

Column B Column C

Column D

Description of security

Date distributed

Date sold

Federal gain

(List each sale separately)

(month, year)

(month, year)

on disposition

5

________

_____________ 00

6

________

_____________ 00

7

________

_____________ 00

8

________

_____________ 00

Step 3: Calculate net unrealized appreciation

Column E

Column F

Column G

Column H

Market value of stock

Federal tax basis of stock

Excess of Column E over Column F

Lesser of Columns G or D

on date of distribution

on date of distribution

(if any)

(See instructions.)

(See instructions.)

9 ________

________

________

________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

1 0 _ _______

________

________

________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

1 1 _ _______

________

________

________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

1 2________

________

________

________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

1 3

13 ________

Write the total here and on Form IL-1040, Line 5 or Form IL-1041, Line 14.

_____________ 00

If you must file a Schedule F (because Line 18 below is a gain), also write this amount on Form IL-1040, Schedule F, Line 13, or

Form IL-1041, Schedule F, Line 14.

Step 4: Identify securities received in a distribution prior to August 1, 1969

Column I

Column J

Column K

Column L

Column M

August 1, 1969, value

Federal tax basis

Excess of Column I over

The greater of Columns H or K

Subtract Column H

(See instructions.)

August 1, 1969

Column J (if any)

but not greater than Column D

from Column L

(See instructions.)

14

_

_

_

_

_ ________________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

1 5

_

_

_

_

_ ________________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

16

_

_

_

_

_ ________________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

17

_

_

_

_

_________________

_____________ 00

_____________ 00

_____________ 00

_____________ 00

18 Total

18 _

_____________ 00

If this amount is a gain, you must complete Schedule F. Write this amount on Form IL-1040, Schedule F, Line 3 or Form IL-1041, Schedule F, Line 3.

*161801110*

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-4644 front (R-12/11)

this information is required. Failure to provide information could result in a penalty.

Reset

Print

1

1 2

2