A

D

R

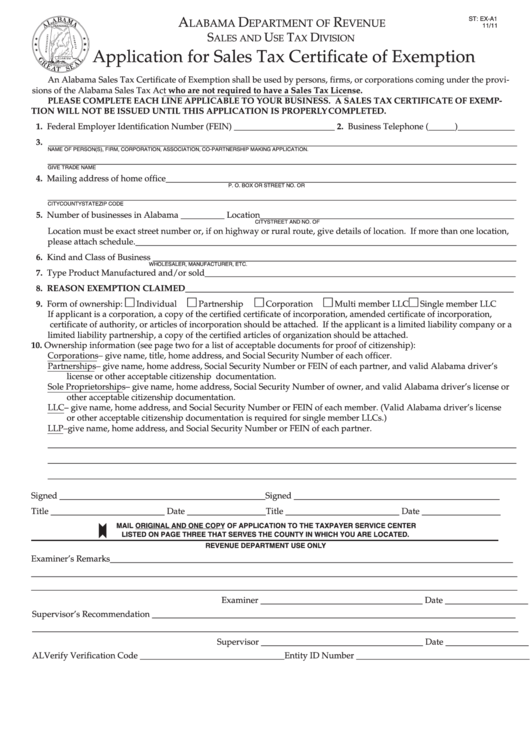

ST: EX-A1

LABAMA

EPARTMENT OF

EVENUE

Reset

11/11

S

U

T

D

ALES AND

SE

AX

IVISION

Application for Sales Tax Certificate of Exemption

An Alabama Sales Tax Certificate of Exemption shall be used by persons, firms, or corporations coming under the provi-

sions of the Alabama Sales Tax Act who are not required to have a Sales Tax License.

PLEASE COMPLETE EACH LINE APPLICABLE TO YOUR BUSINESS. A SALES TAX CERTIFICATE OF EXEMP-

TION WILL NOT BE ISSUED UNTIL THIS APPLICATION IS PROPERLY COMPLETED.

1. Federal Employer Identification Number (FEIN) _______________________ 2. Business Telephone (______)_____________

3. ___________________________________________________________________________________________________________

NAME OF PERSON(S), FIRM, CORPORATION, ASSOCIATION, CO-PARTNERSHIP MAKING APPLICATION.

___________________________________________________________________________________________________________

GIVE TRADE NAME

4. Mailing address of home office________________________________________________________________________________

P. O. BOX OR STREET NO. OR R.F.D.

___________________________________________________________________________________________________________

CITY

COUNTY

STATE

ZIP CODE

5. Number of businesses in Alabama __________ Location __________________________________________________________

CITY

STREET AND NO. OF HWY.

COUNTY

Location must be exact street number or, if on highway or rural route, give details of location. If more than one location,

please attach schedule._______________________________________________________________________________________

6. Kind and Class of Business ___________________________________________________________________________________

WHOLESALER, MANUFACTURER, ETC.

7. Type Product Manufactured and/or sold _______________________________________________________________________

8. REASON EXEMPTION CLAIMED___________________________________________________________________________

9. Form of ownership:

Individual

Partnership

Corporation

Multi member LLC

Single member LLC

If applicant is a corporation, a copy of the certified certificate of incorporation, amended certificate of incorporation,

certificate of authority, or articles of incorporation should be attached. If the applicant is a limited liability company or a

limited liability partnership, a copy of the certified articles of organization should be attached.

10. Ownership information (see page two for a list of acceptable documents for proof of citizenship):

Corporations – give name, title, home address, and Social Security Number of each officer.

Partnerships – give name, home address, Social Security Number or FEIN of each partner, and valid Alabama driver’s

license or other acceptable citizenship documentation.

Sole Proprietorships – give name, home address, Social Security Number of owner, and valid Alabama driver’s license or

other acceptable citizenship documentation.

LLC – give name, home address, and Social Security Number or FEIN of each member. (Valid Alabama driver’s license

or other acceptable citizenship documentation is required for single member LLCs.)

LLP – give name, home address, and Social Security Number or FEIN of each partner.

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Signed _______________________________________________

Signed _______________________________________________

Title __________________________ Date __________________

Title __________________________ Date __________________

MAIL ORIGINAL AND ONE COPY OF APPLICATION TO THE TAXPAYER SERVICE CENTER

LISTED ON PAGE THREE THAT SERVES THE COUNTY IN WHICH YOU ARE LOCATED.

REVENUE DEPARTMENT USE ONLY

Examiner’s Remarks ____________________________________________________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

Examiner _____________________________________ Date ___________________

Supervisor’s Recommendation ___________________________________________________________________________________

_______________________________________________________________________________________________________________

Supervisor _____________________________________ Date ___________________

ALVerify Verification Code _________________________________

Entity ID Number ________________________________________

1

1 2

2 3

3