2011 Elderly Rental Assistance Program

ERA

Form 90R and Instructions

Elderly Rental Assistance (ERA) is for low-income

Where do I send Form 90R?

people age 58 or older who rent their home. ERA

ERA CLAIMS

is based on your income, assets, and the amount of

PO Box 14700

rent, fuel, and utilities you paid. The property you

Salem OR 97309‑0930

rent must be subject to property tax. If the property

When will I get my assistance check?

you rent is exempt from property tax you are not

wner makes

eligible for ERA unless the property o

If you file Form 90R by July 1, 2012, your ERA check

a “payment in lieu of tax” (PILOT). You must

will be mailed to you in November. If your Form

file a Form 90R to receive ERA.

90R is filed after July 1, your check can’t be issued

until November 2013.

You qualify for ERA if all the following are true:

• You or your spouse/registered domestic partner

Fraudulent claims

(RDP) were age 58 or older on December 31, 2011;

Filing a fraudulent Form 90R is against the law. You

and

could be charged with a class C felony. You could

• You and your spouse’s/RDP’s household income

be fined up to $100,000 and serve a jail sentence.

was under $10,000; and

You would also be required to pay back twice the

• You paid more than 20 percent of your household

amount you received plus interest.

income for rent, fuel, and utilities (see “Special

Special instructions

instructions” on this page); and

• The total value of you and your spouse’s/RDP’s

Single. If you were single on December 31, 2011, list

household assets is $25,000 or less (if you or your

only the rent, fuel, and utilities you actually paid.

spouse/RDP are age 65 or older on December 31,

Do not list any amounts paid by anyone else.

there is no limit on the value of household assets);

Roommates. Each roommate can file for ERA. The

and

amount of assistance is based on the rent, fuel, utili-

• You rented an Oregon residence that was subject

ties, household income, and assets of each person.

to property tax or PILOT; and

List the names of all renters and the rent, fuel, and

• You lived in Oregon on December 31; and

utilities you alone paid.

• You didn’t own your residence on December 31

Recently married/registered. Did you marry or

(if you live in a manufactured home, see page 2).

register your domestic partnership during 2011? If

so, you must file jointly. Include the rent, fuel, and

Household income includes all taxable and nontax-

utilities paid both separately and together.

able income. See page 2.

Married/RDP—living together. If you were mar-

Fuel and utilities include the amount you paid in

ried/RDP and living together on December 31, 2011,

2011 for lights, water, garbage, sewer, and heating.

you must file jointly. The assistance is based on the

Do not include food expenses or payments for tele-

rent, fuel, utilities, household income, and assets

phone, cable tv, or internet access.

of both people.

Household assets include real and personal prop-

Married/RDP—living apart. If you were married/

erty described on page 3. See the list on Form 90R.

RDP and permanently living apart on December

31, you may file separately. List only the rent, fuel,

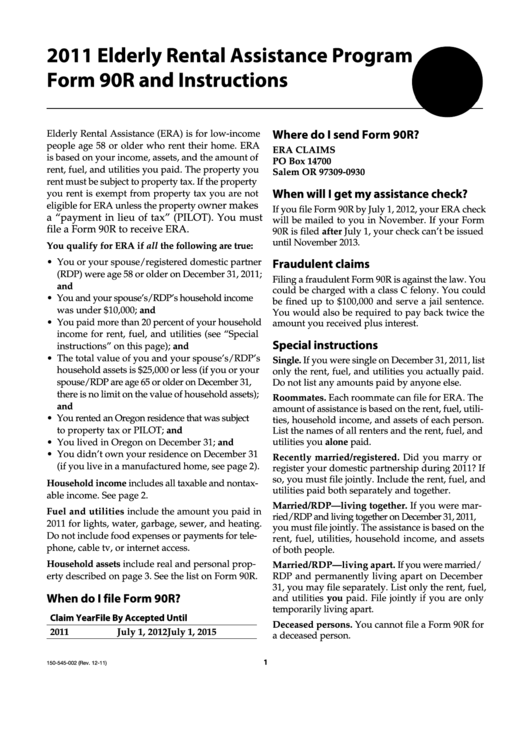

When do I file Form 90R?

and utilities you paid. File jointly if you are only

temporarily living apart.

Claim Year

File By

Accepted Until

Deceased persons. You cannot file a Form 90R for

2011

July 1, 2012

July 1, 2015

a deceased person.

1

150-545-002 (Rev. 12-11)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10