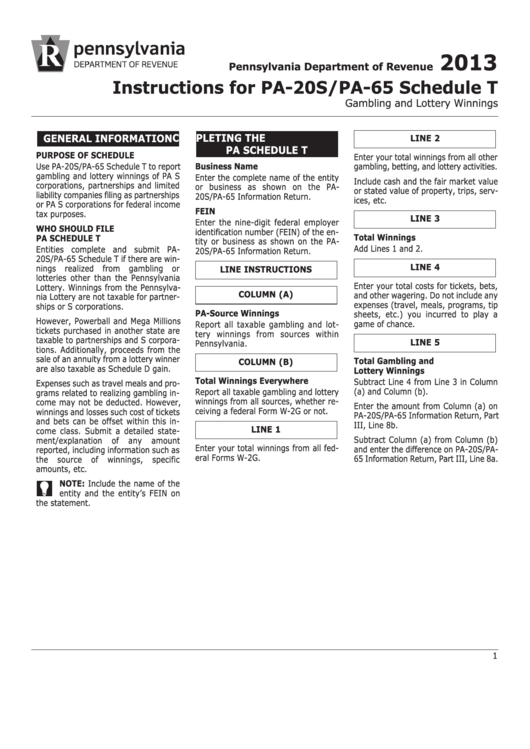

Instructions For Form Pa-20s/pa-65 - Schedule T - Gambling And Lottery Winnings - 2013

ADVERTISEMENT

2013

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule T

Gambling and Lottery Winnings

COMPLETING THE

GENERAL INFORMATION

LINE 2

PA SCHEDULE T

PURPOSE OF SCHEDULE

Enter your total winnings from all other

Use PA-20S/PA-65 Schedule T to report

Business Name

gambling, betting, and lottery activities.

gambling and lottery winnings of PA S

Enter the complete name of the entity

Include cash and the fair market value

corporations, partnerships and limited

or business as shown on the PA-

or stated value of property, trips, serv-

liability companies filing as partnerships

20S/PA-65 Information Return.

ices, etc.

or PA S corporations for federal income

FEIN

tax purposes.

LINE 3

Enter the nine-digit federal employer

WHO SHOULD FILE

identification number (FEIN) of the en-

Total Winnings

PA SCHEDULE T

tity or business as shown on the PA-

Add Lines 1 and 2.

Entities complete and submit PA-

20S/PA-65 Information Return.

20S/PA-65 Schedule T if there are win-

LINE 4

nings realized from gambling or

LINE INSTRUCTIONS

lotteries other than the Pennsylvania

Enter your total costs for tickets, bets,

Lottery. Winnings from the Pennsylva-

COLUMN (A)

and other wagering. Do not include any

nia Lottery are not taxable for partner-

expenses (travel, meals, programs, tip

ships or S corporations.

PA-Source Winnings

sheets, etc.) you incurred to play a

However, Powerball and Mega Millions

game of chance.

Report all taxable gambling and lot-

tickets purchased in another state are

tery winnings from sources within

taxable to partnerships and S corpora-

LINE 5

Pennsylvania.

tions. Additionally, proceeds from the

sale of an annuity from a lottery winner

Total Gambling and

COLUMN (B)

are also taxable as Schedule D gain.

Lottery Winnings

Total Winnings Everywhere

Subtract Line 4 from Line 3 in Column

Expenses such as travel meals and pro-

(a) and Column (b).

Report all taxable gambling and lottery

grams related to realizing gambling in-

winnings from all sources, whether re-

come may not be deducted. However,

Enter the amount from Column (a) on

ceiving a federal Form W-2G or not.

winnings and losses such cost of tickets

PA-20S/PA-65 Information Return, Part

and bets can be offset within this in-

III, Line 8b.

LINE 1

come class. Submit a detailed state-

Subtract Column (a) from Column (b)

ment/explanation

of

any

amount

Enter your total winnings from all fed-

and enter the difference on PA-20S/PA-

reported, including information such as

eral Forms W-2G.

65 Information Return, Part III, Line 8a.

the

source

of

winnings,

specific

amounts, etc.

NOTE: Include the name of the

entity and the entity’s FEIN on

the statement.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1