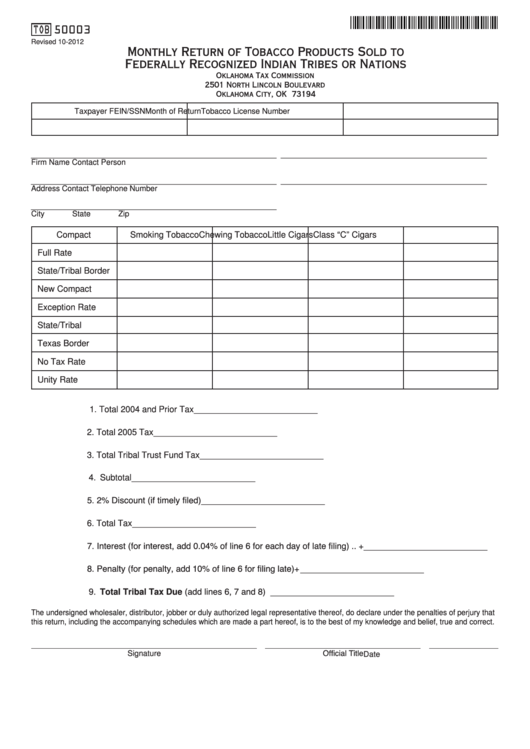

TOB 50003

Revised 10-2012

Monthly Return of Tobacco Products Sold to

Federally Recognized Indian Tribes or Nations

Oklahoma Tax Commission

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

Taxpayer FEIN/SSN

Month of Return

Tobacco License Number

________________________________________________________

_______________________________________________

Firm Name

Contact Person

________________________________________________________

_______________________________________________

Address

Contact Telephone Number

________________________________________________________

City

State

Zip

Compact

Smoking Tobacco

Chewing Tobacco

Little Cigars

Class “C” Cigars

Full Rate

State/Tribal Border

New Compact

Exception Rate

State/Tribal

Texas Border

No Tax Rate

Unity Rate

1. Total 2004 and Prior Tax ........................................................................ __________________________

2. Total 2005 Tax ........................................................................................ __________________________

3. Total Tribal Trust Fund Tax ..................................................................... __________________________

4. Subtotal ................................................................................................. __________________________

5. 2% Discount (if timely filed) ................................................................... __________________________

6. Total Tax ................................................................................................. __________________________

7. Interest (for interest, add 0.04% of line 6 for each day of late filing) .. + __________________________

8. Penalty (for penalty, add 10% of line 6 for filing late).......................... + __________________________

9. Total Tribal Tax Due (add lines 6, 7 and 8) ......................................... __________________________

The undersigned wholesaler, distributor, jobber or duly authorized legal representative thereof, do declare under the penalties of perjury that

this return, including the accompanying schedules which are made a part hereof, is to the best of my knowledge and belief, true and correct.

Official Title

Signature

Date

1

1 2

2 3

3