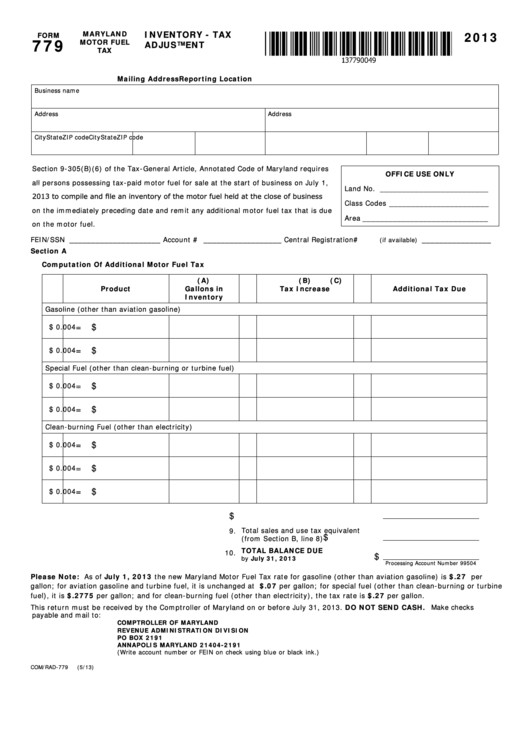

INVENTORY - TAX

MARYLAND

2013

FORM

779

MOTOR FUEL

ADJUSTMENT

TAX

Mailing Address

Reporting Location

Business name

Address

Address

City

State

ZIP code

City

State

ZIP code

Section 9-305(B)(6) of the Tax-General Article, Annotated Code of Maryland requires

OFFICE USE ONLY

all persons possessing tax-paid motor fuel for sale at the start of business on July 1,

Land No. _________________________

2013 to compile and file an inventory of the motor fuel held at the close of business

Class Codes _______________________

on the immediately preceding date and remit any additional motor fuel tax that is due

Area _____________________________

on the motor fuel.

FEIN/SSN _____________________

Account # __________________

Central Registration#

________________

(if available)

Section A

Computation Of Additional Motor Fuel Tax

(A)

(B)

(C)

Product

Gallons in

Tax Increase

Additional Tax Due

Inventory

Gasoline (other than aviation gasoline)

= $

1.

Tax paid Gasoline

X

$ 0.004

= $

2.

Tax paid Ethanol

X

$ 0.004

Special Fuel (other than clean-burning or turbine fuel)

= $

3.

Tax paid Diesel

X

$ 0.004

= $

4.

Tax paid Kerosene

X

$ 0.004

Clean-burning Fuel (other than electricity)

= $

5.

Tax paid Propane

X

$ 0.004

= $

6.

Tax paid CNG

X

$ 0.004

= $

7.

Tax paid LNG

X

$ 0.004

$

8. Total additional tax due

9. Total sales and use tax equivalent

$

(from Section B, line 8)

10. TOTAL BALANCE DUE

$

by July 31, 2013

Processing Account Number 99504

Please Note: As of July 1, 2013 the new Maryland Motor Fuel Tax rate for gasoline (other than aviation gasoline) is $.27 per

gallon; for aviation gasoline and turbine fuel, it is unchanged at $.07 per gallon; for special fuel (other than clean-burning or turbine

fuel), it is $.2775 per gallon; and for clean-burning fuel (other than electricity), the tax rate is $.27 per gallon.

This return must be received by the Comptroller of Maryland on or before July 31, 2013. DO NOT SEND CASH. Make checks

payable and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION

PO BOX 2191

ANNAPOLIS MARYLAND 21404-2191

(Write account number or FEIN on check using blue or black ink.)

COM/RAD-779

(5/13)

1

1 2

2 3

3