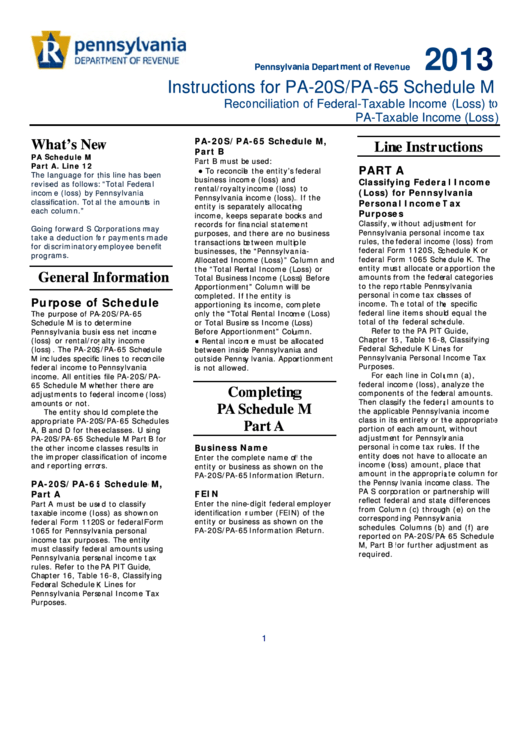

Instructions For Form Pa-20s/pa 65 - Schedule M - Reconciliation Of Federal-Taxable Income (Loss) To Pa-Taxable Income (Loss) - 2013

ADVERTISEMENT

20

013

Pennsylva

ania Departm

ment of Reven

nue

Instr

ruction

s for P

A-20S/

/PA-65

5 Sched

dule M

Reco

onciliation

n of Feder

ral-Taxab

le Income

e (Loss) to

o

PA-Tax

able Inco

me (Loss

)

P

PA-20S/PA

A-65 Sched

dule M,

Wh

hat’s New

w

Lin

ne Instru

uctions

P

Part B

PA S

Schedule M

P

Part B must be

e used:

Part

A. Line 12

PART

A

●

To reconcile

e the entity’s f

federal

The l

anguage for t

this line has b

een

b

business incom

me (loss) and

Classify

ying Federa

al Income

revise

ed as follows:

“Total Federa

al

r

ental/royalty

income (loss)

) to

(Loss) f

for Pennsy

lvania

incom

me (loss) by P

Pennsylvania

P

Pennsylvania i

ncome (loss).

. If the

class

ification. Tota

l the amounts

s in

Persona

al Income T

Tax

e

entity is separ

ately allocatin

ng

each

column.”

Purpose

es

in

ncome, keeps

s separate boo

oks and

Classify, w

without adjust

ment for

r

ecords for fina

ancial stateme

ent

Going

g forward S C

orporations m

may

Pennsylva

nia personal i

ncome tax

p

purposes, and

there are no

business

take

a deduction fo

or payments m

made

rules, the

federal incom

me (loss) from

t

ransactions be

etween multip

ple

for di

iscriminatory

employee ben

nefit

federal Fo

rm 1120S, Sc

chedule K or

b

businesses, th

e “Pennsylvan

nia-

progr

rams.

federal Fo

rm 1065 Sche

edule K. The

A

Allocated Inco

me (Loss)” Co

olumn and

entity mus

st allocate or a

apportion the

t

he “Total Ren

tal Income (L

Loss) or

G

eneral In

nformat

tion

amounts f

from the feder

ral categories

T

Total Business

Income (Loss

s) Before

to the repo

ortable Penns

sylvania

A

Apportionment

t” Column will

l be

personal in

ncome tax cla

asses of

c

completed. If t

the entity is

Pur

rpose of

f Schedu

le

income. Th

he total of the

e specific

a

apportioning it

ts income, com

mplete

federal line

e items should

d equal the

The p

purpose of PA

-20S/PA-65

o

only the “Tota

l Rental Incom

me (Loss)

total of the

e federal sche

edule.

Sche

dule M is to d

etermine

o

or Total Busine

ess Income (L

Loss)

Refer t

to the PA PIT G

Guide,

B

Before Apporti

onment” Colu

umn.

Penn

sylvania busin

ness net incom

me

Chapter 16

6, Table 16-8

, Classifying

●

●

(loss)

) or rental/roy

yalty income

Rental incom

me must be all

located

Federal Sc

chedule K Line

es for

(loss)

). The PA-20S

S/PA-65 Sched

dule

b

between inside

e Pennsylvania

a and

Pennsylva

nia Personal I

Income Tax

M inc

cludes specific

c lines to recon

ncile

o

outside Pennsy

ylvania. Appor

rtionment

Purposes.

feder

ral income to

Pennsylvania

is

s not allowed.

For eac

ch line in Colu

umn (a),

incom

me. All entities

s file PA-20S/

PA-

federal inc

come (loss), a

analyze the

65 Sc

chedule M wh

ether there ar

re

Com

mpleting

g

componen

nts of the fede

eral amounts.

adjus

stments to fed

deral income (

(loss)

Then class

sify the federa

al amounts to

amou

unts or not.

PA Sc

chedule

M

the applica

able Pennsylv

ania income

Th

he entity shou

uld complete t

the

class in its

s entirety or th

he appropriate

e

appro

opriate PA-20

S/PA-65 Sche

edules

P

Part A

portion of

each amount

, without

A, B

and D for thes

se classes. Us

sing

adjustmen

nt for Pennsylv

vania

PA-20

0S/PA-65 Sch

hedule M Part

B for

personal in

ncome tax rul

es. If the

B

Business N

ame

the o

other income c

classes results

s in

entity doe

s not have to

allocate an

the im

mproper class

sification of inc

come

E

Enter the com

plete name of

f the

income (lo

oss) amount, p

place that

and r

reporting erro

rs.

e

entity or busin

ness as shown

n on the

amount in

the appropria

ate column fo

r

P

PA-20S/PA-65

Information R

Return.

the Pennsy

ylvania incom

me class. The

PA-2

20S/PA-65

5 Schedule

e M,

PA S corpo

oration or par

rtnership will

F

FEIN

Part

t A

reflect fed

eral and state

e differences

E

Enter the nine

-digit federal

employer

Part A

A must be use

ed to classify

from Colum

mn (c) throug

gh (e) on the

id

dentification n

number (FEIN

) of the

taxab

ble income (lo

oss) as shown

on

correspond

ding Pennsylv

vania

feder

ral Form 1120

0S or federal F

Form

e

entity or busin

ness as shown

n on the

schedules.

. Columns (b)

and (f) are

P

PA-20S/PA-65

Information R

Return.

1065

for Pennsylva

ania personal

reported o

on PA-20S/PA-

-65 Schedule

incom

me tax purpos

ses. The entity

y

M, Part B f

for further adj

justment as

must

t classify feder

ral amounts u

using

required.

Penn

sylvania perso

onal income t

ax

rules

. Refer to the

PA PIT Guide

e,

Chap

pter 16, Table

16-8, Classify

ying

Feder

ral Schedule K

K Lines for

Penn

sylvania Perso

onal Income T

Tax

Purpo

oses.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8