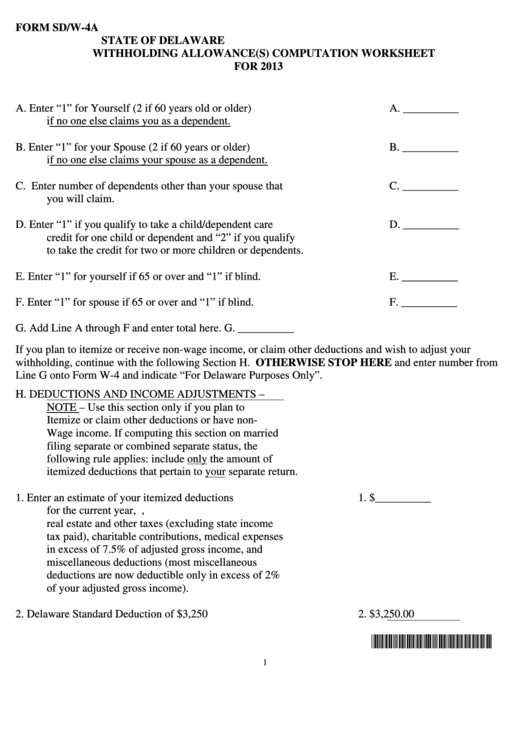

FORM SD/W-4A

STATE OF DELAWARE

WITHHOLDING ALLOWANCE(S) COMPUTATION WORKSHEET

FOR 2013

A.

Enter “1” for Yourself (2 if 60 years old or older)

A. __________

if no one else claims you as a dependent.

B.

Enter “1” for your Spouse (2 if 60 years or older)

B. __________

if no one else claims your spouse as a dependent.

C.

Enter number of dependents other than your spouse that

C. __________

you will claim.

D.

Enter “1” if you qualify to take a child/dependent care

D. __________

credit for one child or dependent and “2” if you qualify

to take the credit for two or more children or dependents.

E.

Enter “1” for yourself if 65 or over and “1” if blind.

E. __________

F.

Enter “1” for spouse if 65 or over and “1” if blind.

F. __________

G.

Add Line A through F and enter total here.

G. __________

If you plan to itemize or receive non-wage income, or claim other deductions and wish to adjust your

withholding, continue with the following Section H. OTHERWISE STOP HERE and enter number from

Line G onto Form W-4 and indicate “For Delaware Purposes Only”.

H.

DEDUCTIONS AND INCOME ADJUSTMENTS –

NOTE – Use this section only if you plan to

Itemize or claim other deductions or have non-

Wage income. If computing this section on married

filing separate or combined separate status, the

following rule applies: include only the amount of

itemized deductions that pertain to your separate return.

1.

Enter an estimate of your itemized deductions

1. $ __________

for the current year, i.e. home mortgage interest,

real estate and other taxes (excluding state income

tax paid), charitable contributions, medical expenses

in excess of 7.5% of adjusted gross income, and

miscellaneous deductions (most miscellaneous

deductions are now deductible only in excess of 2%

of your adjusted gross income).

2.

Delaware Standard Deduction of $3,250

2. $

3,250.00

*DF40913019999*

1

1

1 2

2