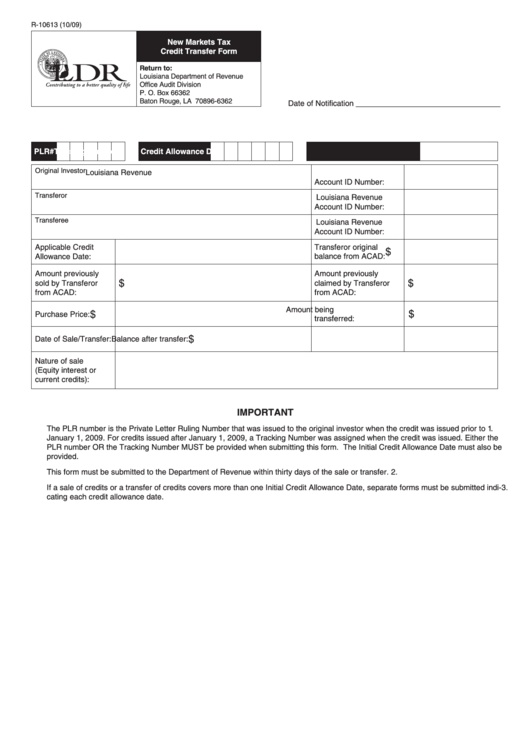

Form R-10613 - New Markets Tax Credit Transfer Form

ADVERTISEMENT

R-10613 (10/09)

New Markets Tax

Credit Transfer Form

Return to:

Louisiana Department of Revenue

Office Audit Division

P. O. Box 66362

Baton Rouge, LA 70896-6362

Date of Notification _________________________________

PLR#

Tracking Number

Initial Credit Allowance Date

Original Investor

Louisiana Revenue

Account ID Number:

Transferor

Louisiana Revenue

Account ID Number:

Transferee

Louisiana Revenue

Account ID Number:

Applicable Credit

Transferor original

$

Allowance Date:

balance from ACAD:

Amount previously

Amount previously

$

$

sold by Transferor

claimed by Transferor

from ACAD:

from ACAD:

Amount being

$

$

Purchase Price:

transferred:

$

Date of Sale/Transfer:

Balance after transfer:

Nature of sale

(Equity interest or

current credits):

IMPORTANT

1.

The PLR number is the Private Letter Ruling Number that was issued to the original investor when the credit was issued prior to

January 1, 2009. For credits issued after January 1, 2009, a Tracking Number was assigned when the credit was issued. Either the

PLR number OR the Tracking Number MUST be provided when submitting this form. The Initial Credit Allowance Date must also be

provided.

2.

This form must be submitted to the Department of Revenue within thirty days of the sale or transfer.

3.

If a sale of credits or a transfer of credits covers more than one Initial Credit Allowance Date, separate forms must be submitted indi-

cating each credit allowance date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1