Form F-1156z - Florida Enterprise Zone Jobs Credit Certificate Of Eligibility For Corporate Income Tax

ADVERTISEMENT

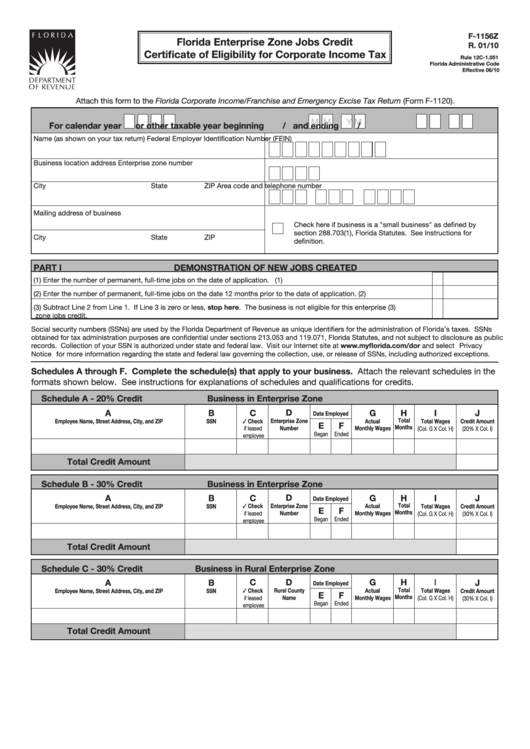

F-1156Z

Florida Enterprise Zone Jobs Credit

R. 01/10

Certificate of Eligibility for Corporate Income Tax

Rule 12C-1.051

Florida Administrative Code

Effective 06/10

Attach this form to the Florida Corporate Income/Franchise and Emergency Excise Tax Return (Form F-1120).

M M

Y Y

M M

Y Y

For calendar year

or other taxable year beginning

/

and ending

/

Name (as shown on your tax return)

Federal Employer Identification Number (FEIN)

Business location address

Enterprise zone number

City

State

ZIP

Area code and telephone number

—

—

Mailing address of business

Check here if business is a "small business" as defined by

section 288.703(1), Florida Statutes. See Instructions for

City

State

ZIP

definition.

PART I

DEmonsTRATIon oF nEw Jobs CREATED

(1)

Enter the number of permanent, full-time jobs on the date of application.

(1)

(2)

Enter the number of permanent, full-time jobs on the date 12 months prior to the date of application.

(2)

(3)

Subtract Line 2 from Line 1. If Line 3 is zero or less, stop here. The business is not eligible for this enterprise

(3)

zone jobs credit.

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs

obtained for tax administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public

records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at and select “Privacy

Notice” for more information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

schedules A through F. Complete the schedule(s) that apply to your business. Attach the relevant schedules in the

formats shown below. See instructions for explanations of schedules and qualifications for credits.

schedule A - 20% Credit

business in Enterprise Zone

D

A

b

C

G

H

I

J

Date Employed

Total

✓ Check

Enterprise Zone

Actual

Employee name, street Address, City, and ZIP

SSN

Total wages

Credit Amount

E

F

Months

number

if leased

monthly wages

(Col. G X Col. H)

(20% X Col. I)

Began

Ended

employee

Total Credit Amount

schedule b - 30% Credit

business in Enterprise Zone

C

D

G

H

A

b

I

J

Date Employed

Enterprise Zone

Total

Employee name, street Address, City, and ZIP

SSN

✓ Check

Actual

Total wages

Credit Amount

E

F

Months

number

monthly wages

if leased

(Col. G X Col. H)

(30% X Col. I)

Began

Ended

employee

Total Credit Amount

schedule C - 30% Credit

business in Rural Enterprise Zone

A

b

C

D

G

H

I

J

Date Employed

Rural County

Total

Employee name, street Address, City, and ZIP

SSN

✓ Check

Actual

Total wages

Credit Amount

E

F

Months

if leased

name

monthly wages

(Col. G X Col. H)

(30% X Col. I)

Began

Ended

employee

Total Credit Amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4